Summary

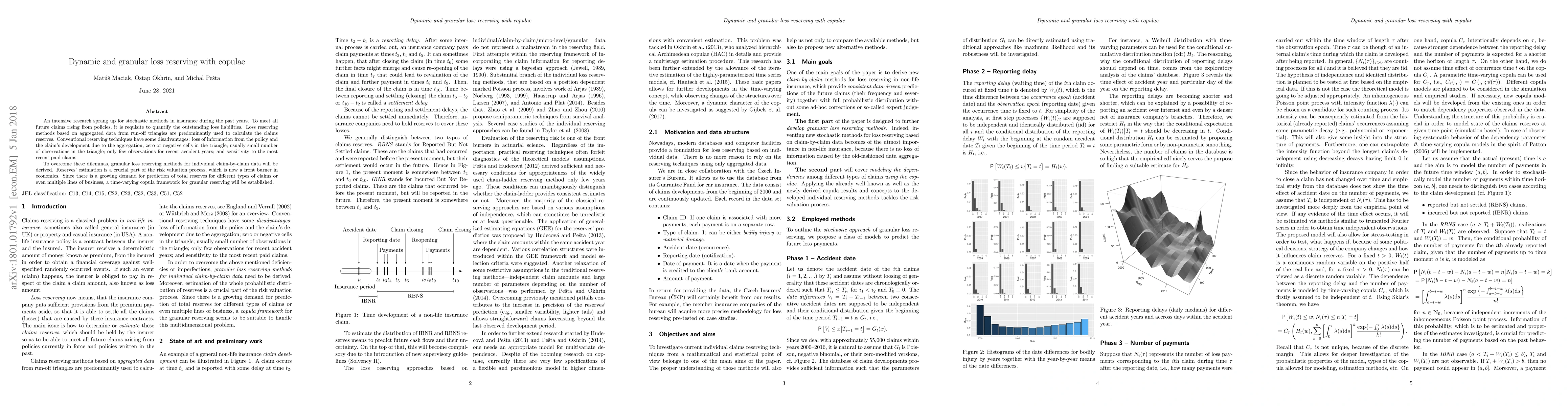

An intensive research sprang up for stochastic methods in insurance during the past years. To meet all future claims rising from policies, it is requisite to quantify the outstanding loss liabilities. Loss reserving methods based on aggregated data from run-off triangles are predominantly used to calculate the claims reserves. Conventional reserving techniques have some disadvantages: loss of information from the policy and the claim's development due to the aggregation, zero or negative cells in the triangle; usually small number of observations in the triangle; only few observations for recent accident years; and sensitivity to the most recent paid claims. To overcome these dilemmas, granular loss reserving methods for individual claim-by-claim data will be derived. Reserves' estimation is a crucial part of the risk valuation process, which is now a front burner in economics. Since there is a growing demand for prediction of total reserves for different types of claims or even multiple lines of business, a time-varying copula framework for granular reserving will be established.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic Loss Reserving: Dependence and Estimation

Yang Shen, Andrew Fleck, Edward Furman

Ensemble distributional forecasting for insurance loss reserving

Benjamin Avanzi, Bernard Wong, Yanfeng Li et al.

Stochastic loss reserving with mixture density neural networks

Benjamin Avanzi, Greg Taylor, Bernard Wong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)