Authors

Summary

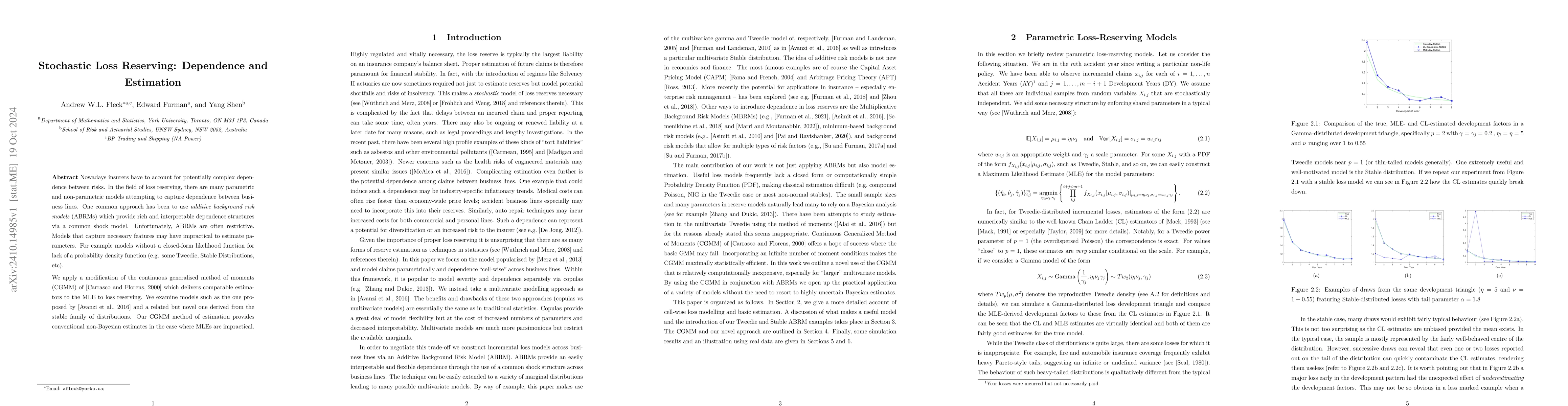

Nowadays insurers have to account for potentially complex dependence between risks. In the field of loss reserving, there are many parametric and non-parametric models attempting to capture dependence between business lines. One common approach has been to use additive background risk models (ABRMs) which provide rich and interpretable dependence structures via a common shock model. Unfortunately, ABRMs are often restrictive. Models that capture necessary features may have impractical to estimate parameters. For example models without a closed-form likelihood function for lack of a probability density function (e.g. some Tweedie, Stable Distributions, etc). We apply a modification of the continuous generalised method of moments (CGMM) of [Carrasco and Florens, 2000] which delivers comparable estimators to the MLE to loss reserving. We examine models such as the one proposed by [Avanzi et al., 2016] and a related but novel one derived from the stable family of distributions. Our CGMM method of estimation provides conventional non-Bayesian estimates in the case where MLEs are impractical.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel error and its estimation, with particular application to loss reserving

G Taylor, G McGuire

Stochastic loss reserving with mixture density neural networks

Benjamin Avanzi, Greg Taylor, Bernard Wong et al.

No citations found for this paper.

Comments (0)