Summary

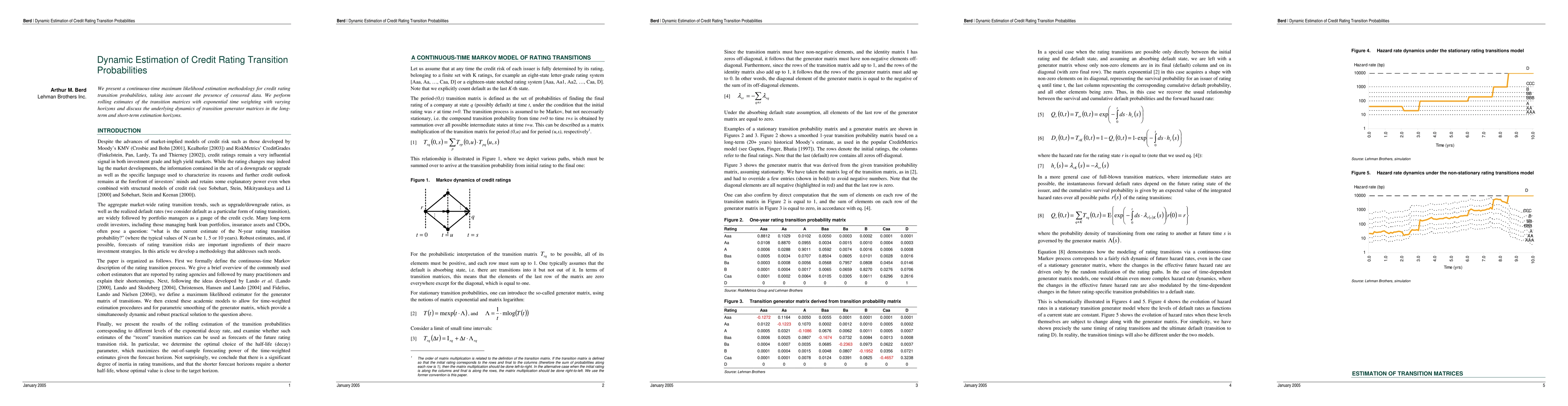

We present a continuous-time maximum likelihood estimation methodology for credit rating transition probabilities, taking into account the presence of censored data. We perform rolling estimates of the transition matrices with exponential time weighting with varying horizons and discuss the underlying dynamics of transition generator matrices in the long-term and short-term estimation horizons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)