Summary

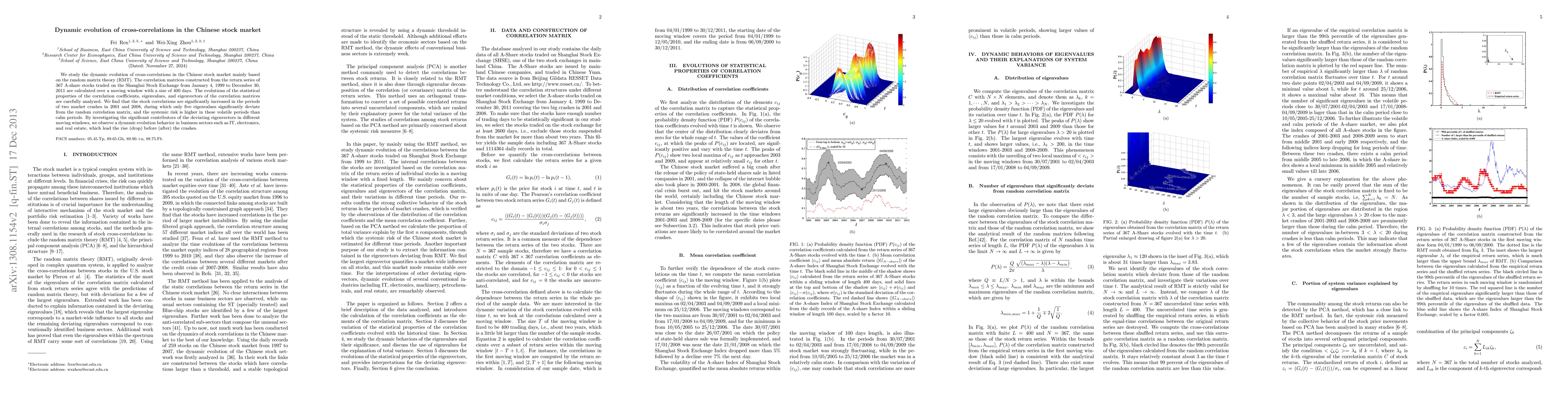

We study the dynamic evolution of cross-correlations in the Chinese stock market mainly based on the random matrix theory (RMT). The correlation matrices constructed from the return series of 367 A-share stocks traded on the Shanghai Stock Exchange from January 4, 1999 to December 30, 2011 are calculated over a moving window with a size of 400 days. The evolutions of the statistical properties of the correlation coefficients, eigenvalues, and eigenvectors of the correlation matrices are carefully analyzed. We find that the stock correlations are significantly increased in the periods of two market crashes in 2001 and 2008, during which only five eigenvalues significantly deviate from the random correlation matrix, and the systemic risk is higher in these volatile periods than calm periods. By investigating the significant contributors of the deviating eigenvectors in different moving windows, we observe a dynamic evolution behavior in business sectors such as IT, electronics, and real estate, which lead the rise (drop) before (after) the crashes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)