Summary

Dynamic hedging strategies are essential for effective risk management in derivatives markets, where volatility and market sentiment can greatly impact performance. This paper introduces a novel framework that leverages large language models (LLMs) for sentiment analysis and news analytics to inform hedging decisions. By analyzing textual data from diverse sources like news articles, social media, and financial reports, our approach captures critical sentiment indicators that reflect current market conditions. The framework allows for real-time adjustments to hedging strategies, adapting positions based on continuous sentiment signals. Backtesting results on historical derivatives data reveal that our dynamic hedging strategies achieve superior risk-adjusted returns compared to conventional static approaches. The incorporation of LLM-driven sentiment analysis into hedging practices presents a significant advancement in decision-making processes within derivatives trading. This research showcases how sentiment-informed dynamic hedging can enhance portfolio management and effectively mitigate associated risks.

AI Key Findings

Generated Jun 10, 2025

Methodology

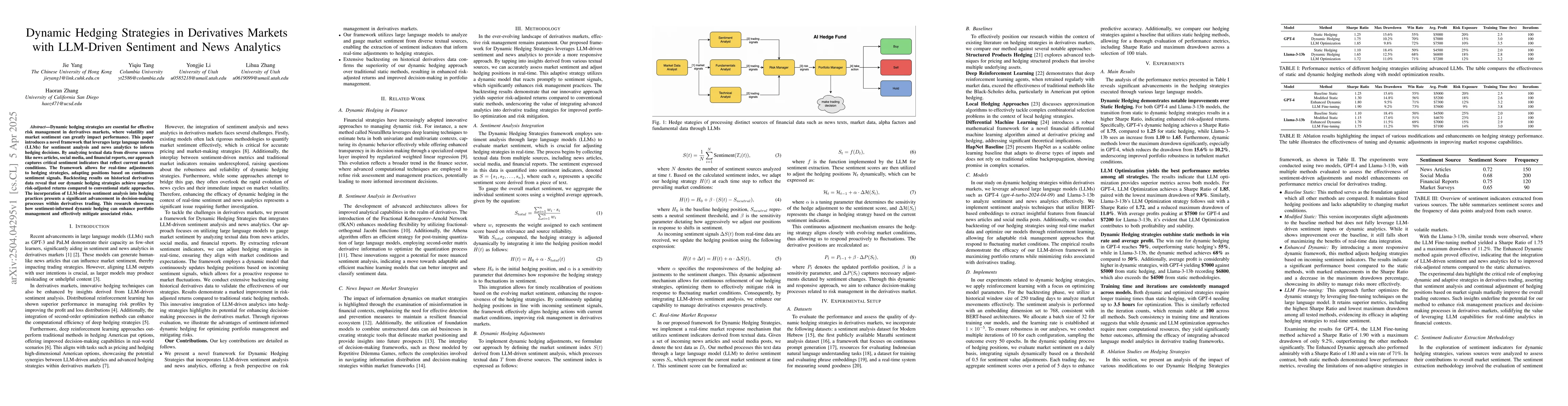

This research introduces a novel framework leveraging large language models (LLMs) for sentiment analysis and news analytics to inform dynamic hedging decisions in derivatives markets, allowing for real-time adjustments based on continuous sentiment signals.

Key Results

- Dynamic hedging strategies achieved superior risk-adjusted returns compared to static approaches in backtesting on historical derivatives data.

- GPT-4's dynamic hedging strategy achieved a Sharpe Ratio of 1.75, compared to 1.25 for static hedging.

- Llama-3-13b's dynamic hedging strategy increased the Sharpe Ratio from 1.10 to 1.65.

- LLM optimization strategies yielded the best performance metrics, with GPT-4's LLM optimization achieving a Sharpe Ratio of 1.85 and a maximum drawdown of 9.8%.

- Dynamic hedging strategies outperformed static methods in win rate and average profit, with GPT-4 dynamic hedging reaching a 70% win rate and $7,000 average profit against $5,000 for static hedging.

Significance

This research showcases the potential of sentiment-informed dynamic hedging to enhance portfolio management and effectively mitigate risks in derivatives trading.

Technical Contribution

The paper presents a dynamic hedging framework that utilizes LLM-driven sentiment and news analytics for real-time adjustments in derivatives trading.

Novelty

The research introduces a novel approach by combining LLMs with dynamic hedging strategies, providing a significant advancement in decision-making processes within derivatives trading.

Limitations

- The study did not address the computational resources required for real-time sentiment analysis and dynamic hedging adjustments.

- The backtesting was conducted on historical data, and future research should validate the approach on live market data.

Future Work

- Investigate the scalability of the proposed framework for high-frequency trading environments.

- Explore the integration of additional data sources, such as alternative data, to further improve the sentiment analysis and hedging strategies.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Inflation Nowcasting with LLM: Sentiment Analysis on News

Marc-Antoine Allard, Paul Teiletche, Adam Zinebi

Stress index strategy enhanced with financial news sentiment analysis for the equity markets

Baptiste Lefort, Eric Benhamou, Jean-Jacques Ohana et al.

No citations found for this paper.

Comments (0)