Summary

The purpose of this paper is to improve the accuracy of dynamic hedging using implied volatilities generated by genetic programming. Using real data from S&P500 index options, the genetic programming's ability to forecast Black and Scholes implied volatility is compared between static and dynamic training-subset selection methods. The performance of the best generated GP implied volatilities is tested in dynamic hedging and compared with Black-Scholes model. Based on MSE total, the dynamic training of GP yields better results than those obtained from static training with fixed samples. According to hedging errors, the GP model is more accurate almost in all hedging strategies than the BS model, particularly for in-the-money call options and at-the-money put options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

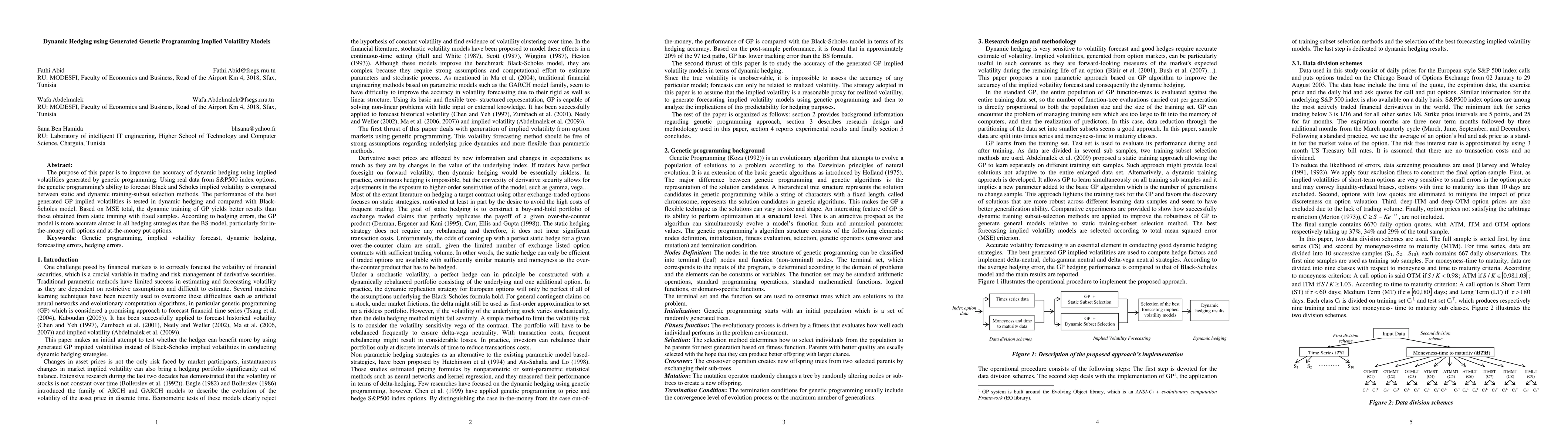

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Hedging with Options Using the Implied Volatility Surface

Pascal François, Geneviève Gauthier, Frédéric Godin et al.

Enhancing Deep Hedging of Options with Implied Volatility Surface Feedback Information

Pascal François, Geneviève Gauthier, Frédéric Godin et al.

No citations found for this paper.

Comments (0)