Summary

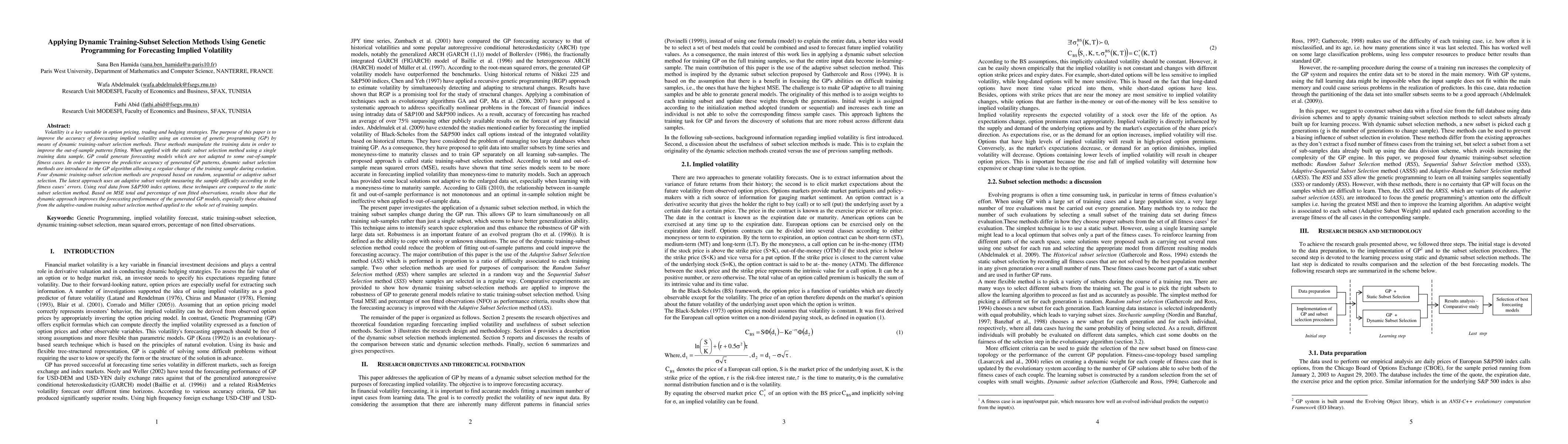

Volatility is a key variable in option pricing, trading and hedging strategies. The purpose of this paper is to improve the accuracy of forecasting implied volatility using an extension of genetic programming (GP) by means of dynamic training-subset selection methods. These methods manipulate the training data in order to improve the out of sample patterns fitting. When applied with the static subset selection method using a single training data sample, GP could generate forecasting models which are not adapted to some out of sample fitness cases. In order to improve the predictive accuracy of generated GP patterns, dynamic subset selection methods are introduced to the GP algorithm allowing a regular change of the training sample during evolution. Four dynamic training-subset selection methods are proposed based on random, sequential or adaptive subset selection. The latest approach uses an adaptive subset weight measuring the sample difficulty according to the fitness cases errors. Using real data from SP500 index options, these techniques are compared to the static subset selection method. Based on MSE total and percentage of non fitted observations, results show that the dynamic approach improves the forecasting performance of the generated GP models, specially those obtained from the adaptive random training subset selection method applied to the whole set of training samples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)