Summary

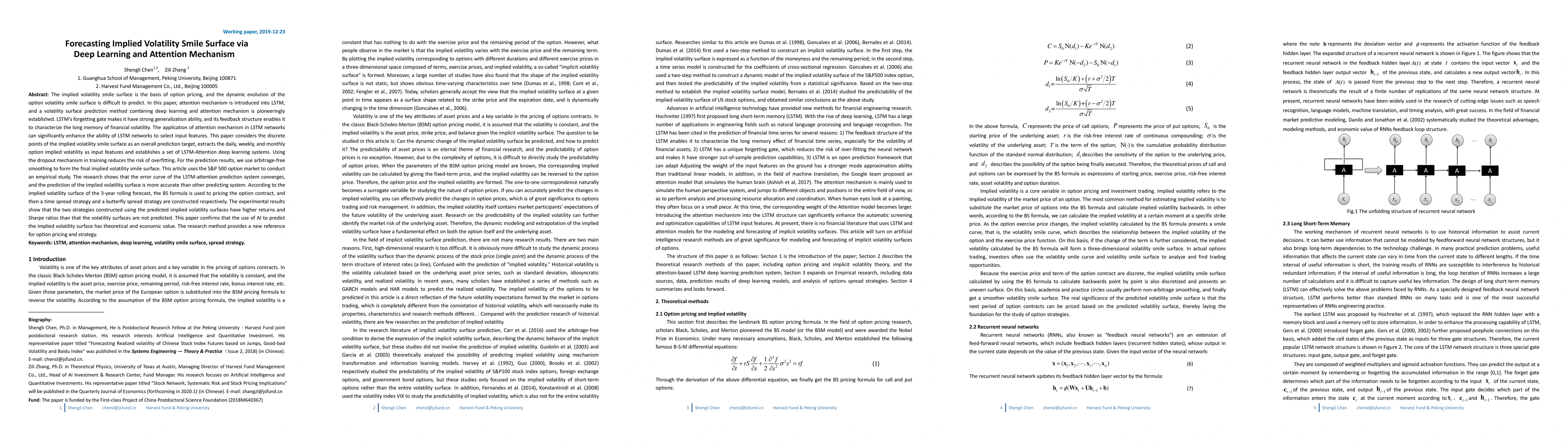

The implied volatility smile surface is the basis of option pricing, and the dynamic evolution of the option volatility smile surface is difficult to predict. In this paper, attention mechanism is introduced into LSTM, and a volatility surface prediction method combining deep learning and attention mechanism is pioneeringly established. LSTM's forgetting gate makes it have strong generalization ability, and its feedback structure enables it to characterize the long memory of financial volatility. The application of attention mechanism in LSTM networks can significantly enhance the ability of LSTM networks to select input features. The experimental results show that the two strategies constructed using the predicted implied volatility surfaces have higher returns and Sharpe ratios than that the volatility surfaces are not predicted. This paper confirms that the use of AI to predict the implied volatility surface has theoretical and economic value. The research method provides a new reference for option pricing and strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

No-Arbitrage Deep Calibration for Volatility Smile and Skewness

Paolo Barucca, Kentaro Hoshisashi, Carolyn E. Phelan

Degree of Irrationality: Sentiment and Implied Volatility Surface

Yan Xie, Jiahao Weng

| Title | Authors | Year | Actions |

|---|

Comments (0)