Summary

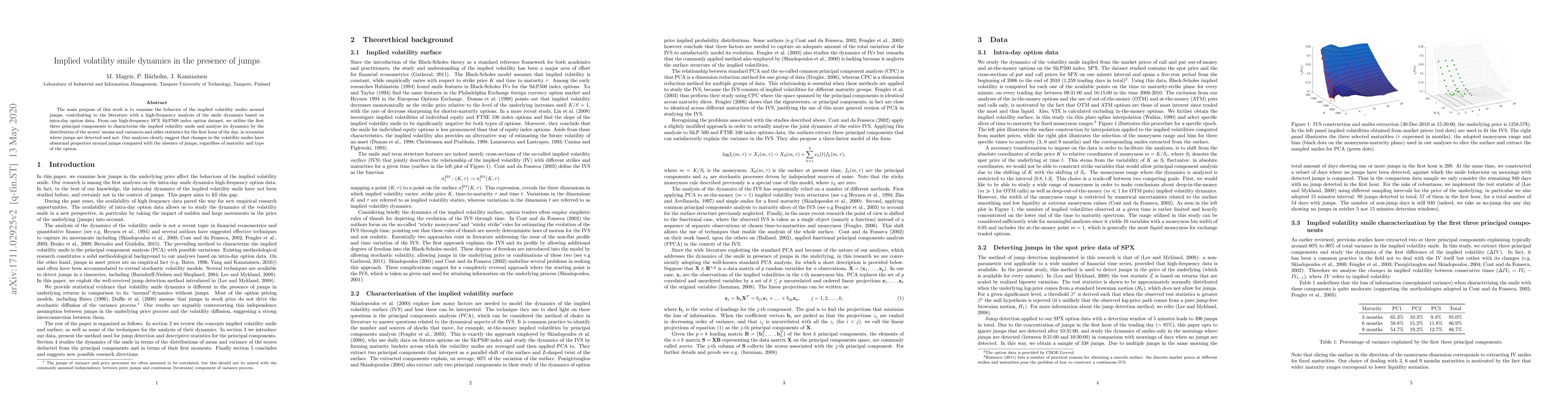

The main purpose of this work is to examine the behavior of the implied volatility smiles around jumps, contributing to the literature with a high-frequency analysis of the smile dynamics based on intra-day option data. From our high-frequency SPX S\&P500 index option dataset, we utilize the first three principal components to characterize the implied volatility smile and analyze its dynamics by the distribution of the scores' means and variances and other statistics for the first hour of the day, in scenarios where jumps are detected and not. Our analyses clearly suggest that changes in the volatility smiles have abnormal properties around jumps compared with the absence of jumps, regardless of maturity and type of the option.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

| Title | Authors | Year | Actions |

|---|

Comments (0)