Summary

Raftery, Karny, and Ettler (2010) introduce an estimation technique, which they refer to as Dynamic Model Averaging (DMA). In their application, DMA is used to predict the output strip thickness for a cold rolling mill, where the output is measured with a time delay. Recently, DMA has also shown to be useful in macroeconomic and financial applications. In this paper, we present the eDMA package for DMA estimation implemented in R. The eDMA package is especially suited for practitioners in economics and finance, where typically a large number of predictors are available. Our implementation is up to 133 times faster then a standard implementation using a single-core CPU. Thus, with the help of this package, practitioners are able to perform DMA on a standard PC without resorting to large clusters, which are not easily available to all researchers. We demonstrate the usefulness of this package through simulation experiments and an empirical application using quarterly U.S. inflation data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

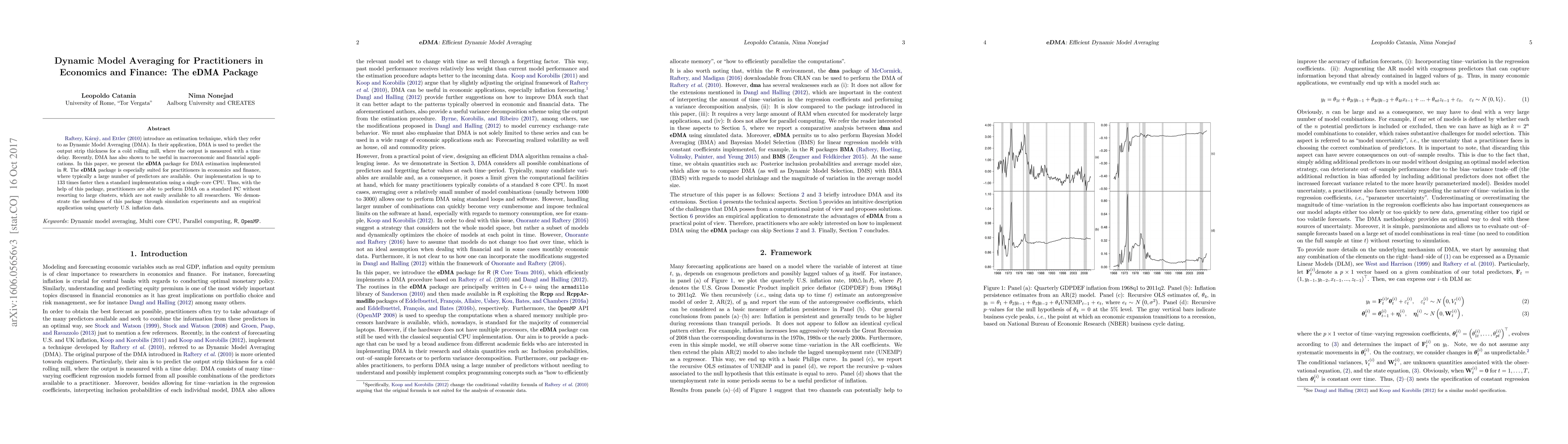

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Forecasting in Economics and Finance: A Modern Review

Florian Huber, Anastasios Panagiotelis, Gary Koop et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)