Summary

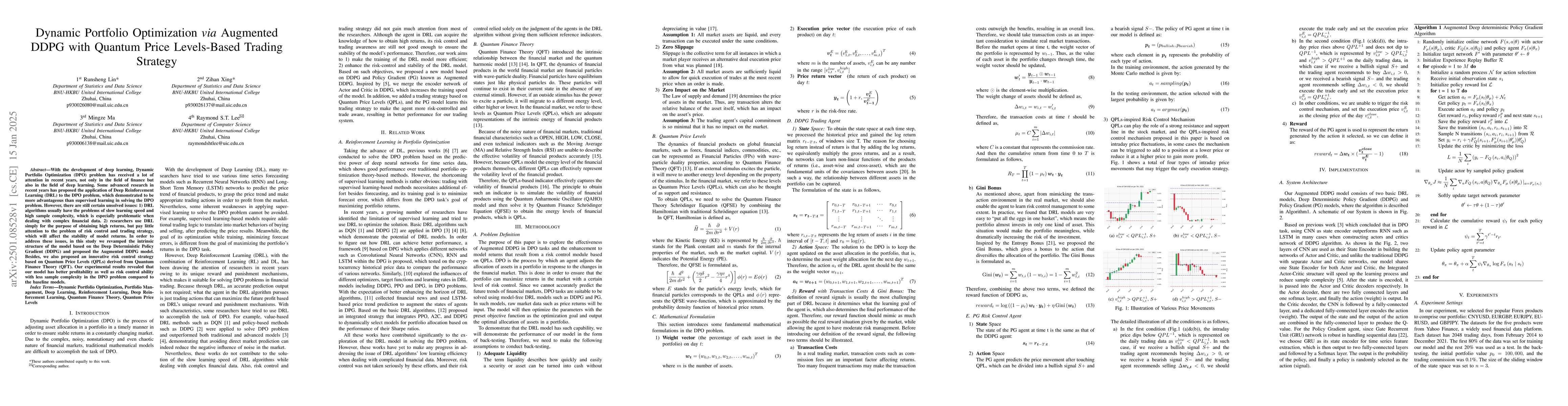

With the development of deep learning, Dynamic Portfolio Optimization (DPO) problem has received a lot of attention in recent years, not only in the field of finance but also in the field of deep learning. Some advanced research in recent years has proposed the application of Deep Reinforcement Learning (DRL) to the DPO problem, which demonstrated to be more advantageous than supervised learning in solving the DPO problem. However, there are still certain unsolved issues: 1) DRL algorithms usually have the problems of slow learning speed and high sample complexity, which is especially problematic when dealing with complex financial data. 2) researchers use DRL simply for the purpose of obtaining high returns, but pay little attention to the problem of risk control and trading strategy, which will affect the stability of model returns. In order to address these issues, in this study we revamped the intrinsic structure of the model based on the Deep Deterministic Policy Gradient (DDPG) and proposed the Augmented DDPG model. Besides, we also proposed an innovative risk control strategy based on Quantum Price Levels (QPLs) derived from Quantum Finance Theory (QFT). Our experimental results revealed that our model has better profitability as well as risk control ability with less sample complexity in the DPO problem compared to the baseline models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-aware Trading Portfolio Optimization

Gianmarco De Francisci Morales, Gabriele D'Acunto, Fabio Vitale et al.

DDPG based on multi-scale strokes for financial time series trading strategy

Zhi Cai, Jun-Cheng Chen, Cong-Xiao Chen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)