Summary

In this paper we consider a utility maximization problem with defaultable stocks and looping contagion risk. We assume that the default intensity of one company depends on the stock prices of itself and other companies, and the default of the company induces immediate drops in the stock prices of the surviving companies. We prove that the value function is the unique viscosity solution of the HJB equation. We also perform some numerical tests to compare and analyse the statistical distributions of the terminal wealth of log utility and power utility based on two strategies, one using the full information of intensity process and the other a proxy constant intensity process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

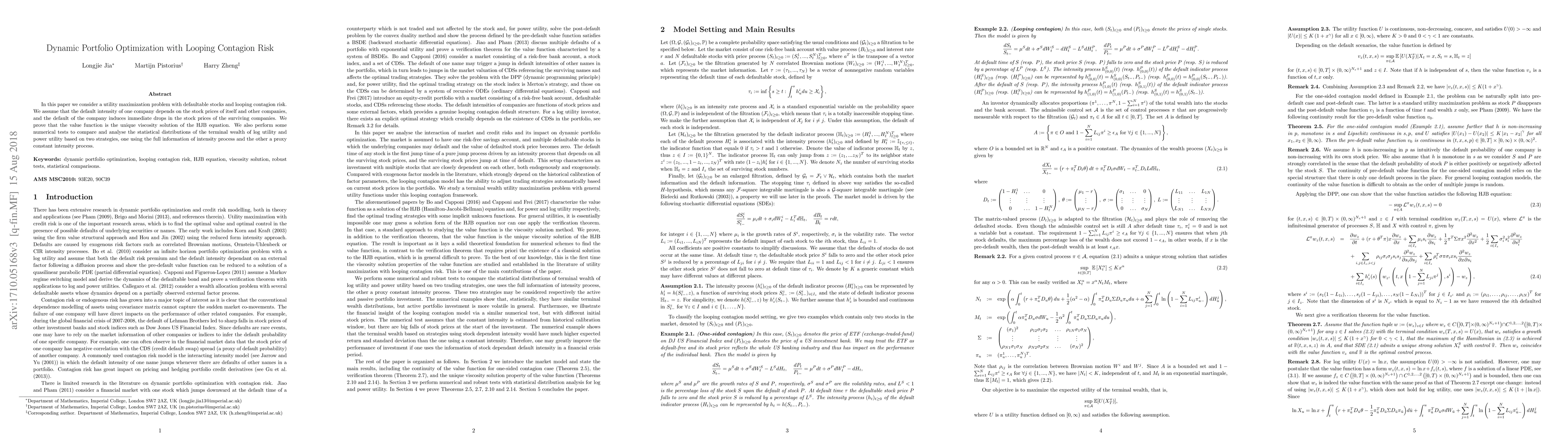

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)