Summary

We study an open problem of risk-sensitive portfolio allocation in a regime-switching credit market with default contagion. The state space of the Markovian regime-switching process is assumed to be a countably infinite set. To characterize the value function, we investigate the corresponding recursive infinite-dimensional nonlinear dynamical programming equations (DPEs) based on default states. We propose to work in the following procedure: Applying the theory of monotone dynamical system, we first establish the existence and uniqueness of classical solutions to the recursive DPEs by a truncation argument in the finite state space. The associated optimal feedback strategy is characterized by developing a rigorous verification theorem. Building upon results in the first stage, we construct a sequence of approximating risk sensitive control problems with finite states and prove that the resulting smooth value functions will converge to the classical solution of the original system of DPEs. The construction and approximation of the optimal feedback strategy for the original problem are also thoroughly discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

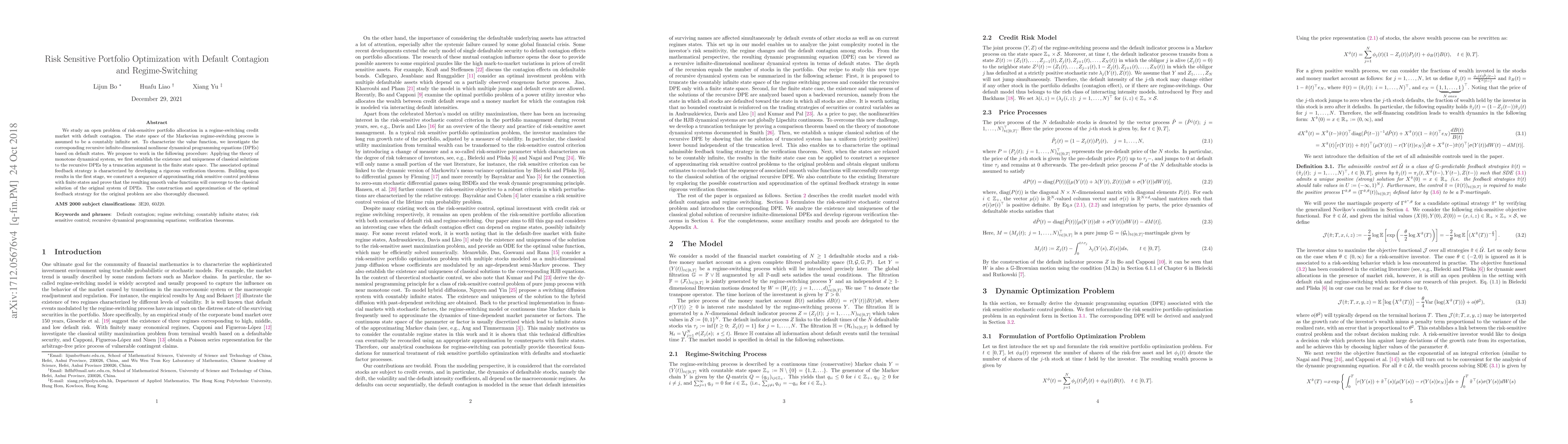

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio Optimization on Multivariate Regime Switching GARCH Model with Normal Tempered Stable Innovation

Cheng Peng, Young Shin Kim, Stefan Mittnik

| Title | Authors | Year | Actions |

|---|

Comments (0)