Summary

Motivated by posted price auctions where buyers are grouped in an unknown number of latent types characterized by their private values for the good on sale, we investigate revenue maximization in stochastic dynamic pricing when the distribution of buyers' private values is supported on an unknown set of points in [0,1] of unknown cardinality $K$. This setting can be viewed as an instance of a stochastic $K$-armed bandit problem where the location of the arms (the $K$ unknown valuations) must be learned as well. In the distribution-free case, we prove that our setting is just as hard as $K$-armed stochastic bandits: no algorithm can achieve a regret significantly better than $\sqrt{KT}$, (where T is the time horizon); we present an efficient algorithm matching this lower bound up to logarithmic factors. In the distribution-dependent case, we show that for all $K>2$ our setting is strictly harder than $K$-armed stochastic bandits by proving that it is impossible to obtain regret bounds that grow logarithmically in time or slower. On the other hand, when a lower bound $\gamma>0$ on the smallest drop in the demand curve is known, we prove an upper bound on the regret of order $(1/\Delta+(\log \log T)/\gamma^2)(K\log T)$. This is a significant improvement on previously known regret bounds for discontinuous demand curves, that are at best of order $(K^{12}/\gamma^8)\sqrt{T}$. When $K=2$ in the distribution-dependent case, the hardness of our setting reduces to that of a stochastic $2$-armed bandit: we prove that an upper bound of order $(\log T)/\Delta$ (up to $\log\log$ factors) on the regret can be achieved with no information on the demand curve. Finally, we show a $O(\sqrt{T})$ upper bound on the regret for the setting in which the buyers' decisions are nonstochastic, and the regret is measured with respect to the best between two fixed valuations one of which is known to the seller.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

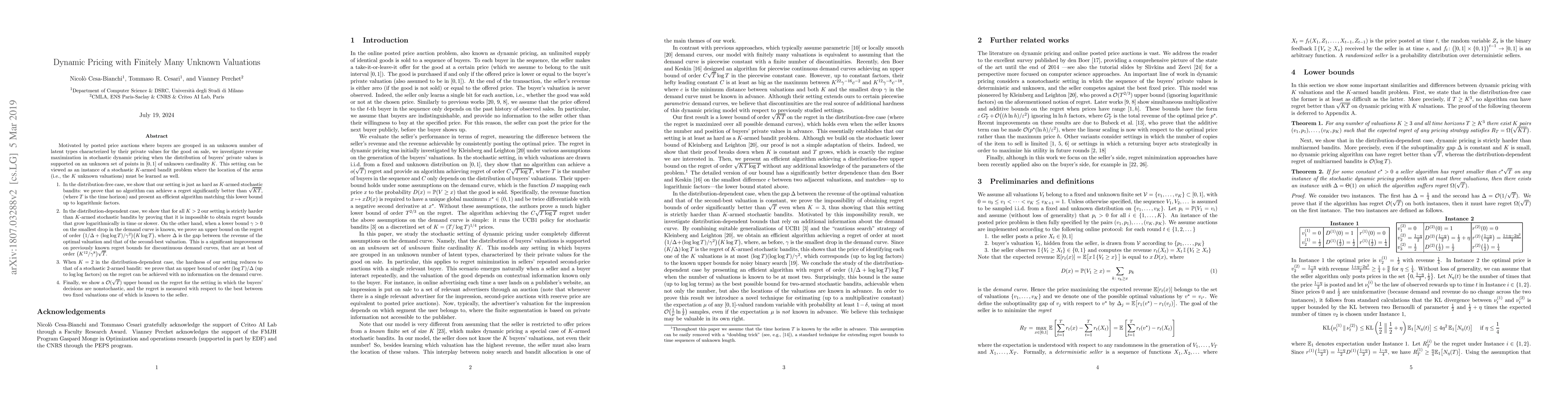

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)