Summary

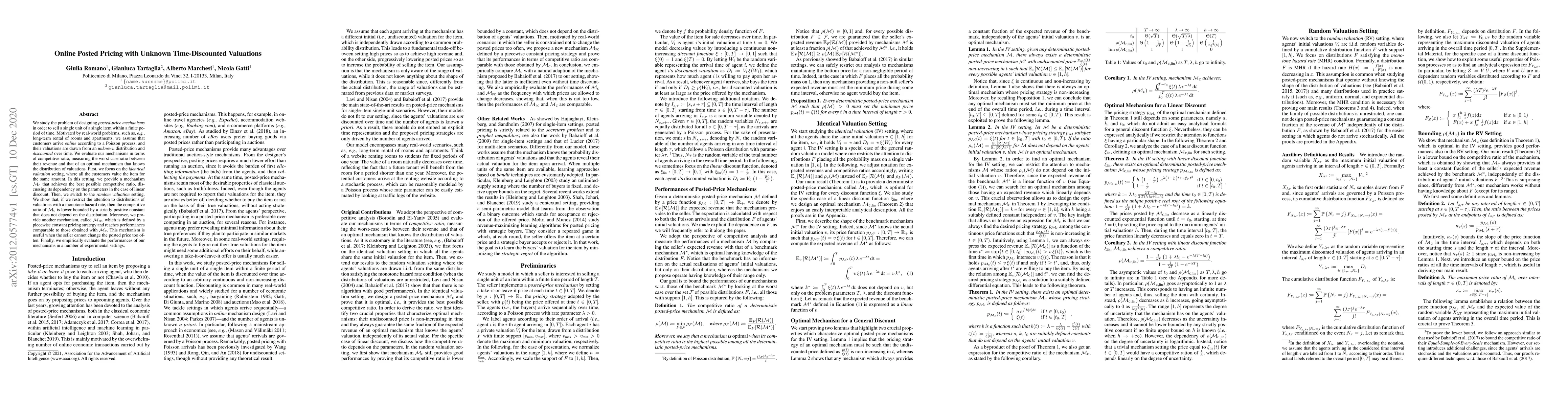

We study the problem of designing posted-price mechanisms in order to sell a single unit of a single item within a finite period of time. Motivated by real-world problems, such as, e.g., long-term rental of rooms and apartments, we assume that customers arrive online according to a Poisson process, and their valuations are drawn from an unknown distribution and discounted over time. We evaluate our mechanisms in terms of competitive ratio, measuring the worst-case ratio between their revenue and that of an optimal mechanism that knows the distribution of valuations. First, we focus on the identical valuation setting, where all the customers value the item for the same amount. In this setting, we provide a mechanism M_c that achieves the best possible competitive ratio, discussing its dependency on the parameters in the case of linear discount. Then, we switch to the random valuation setting. We show that, if we restrict the attention to distributions of valuations with a monotone hazard rate, then the competitive ratio of M_c is lower bounded by a strictly positive constant that does not depend on the distribution. Moreover, we provide another mechanism, called M_pc, which is defined by a piecewise constant pricing strategy and reaches performances comparable to those obtained with M_c. This mechanism is useful when the seller cannot change the posted price too often. Finally, we empirically evaluate the performances of our mechanisms in a number of experimental settings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPosted Pricing and Competition in Large Markets

Victor Verdugo, Vasilis Livanos, José Correa et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)