Summary

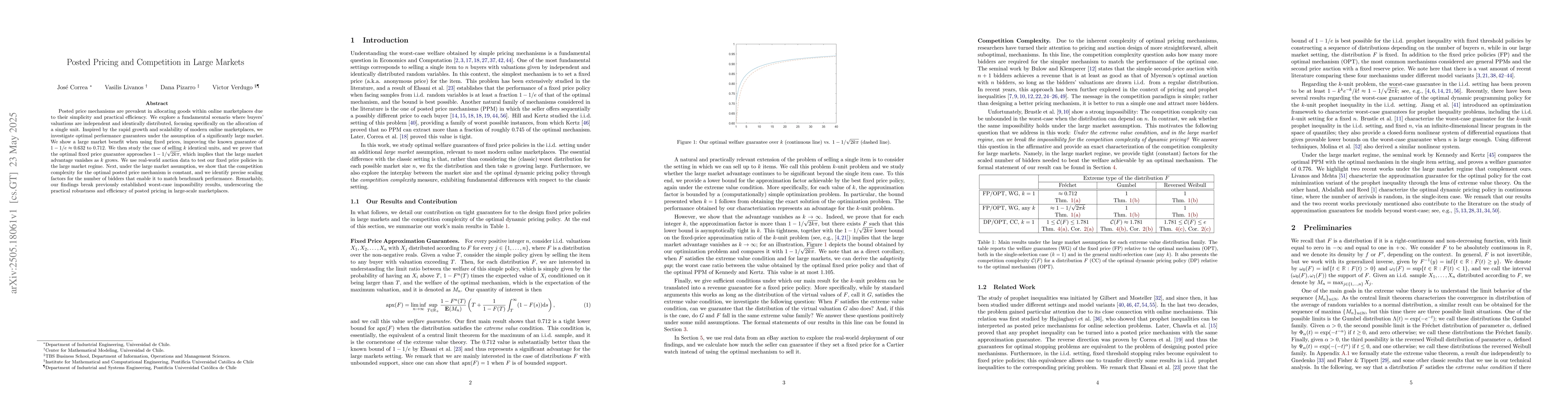

Posted price mechanisms are prevalent in allocating goods within online marketplaces due to their simplicity and practical efficiency. We explore a fundamental scenario where buyers' valuations are independent and identically distributed, focusing specifically on the allocation of a single unit. Inspired by the rapid growth and scalability of modern online marketplaces, we investigate optimal performance guarantees under the assumption of a significantly large market. We show a large market benefit when using fixed prices, improving the known guarantee of $1-1/e\approx 0.632$ to $0.712$. We then study the case of selling $k$ identical units, and we prove that the optimal fixed price guarantee approaches $1-1/\sqrt{2k \pi}$, which implies that the large market advantage vanishes as $k$ grows. We use real-world auction data to test our fixed price policies in the large market regime. Next, under the large market assumption, we show that the competition complexity for the optimal posted price mechanism is constant, and we identify precise scaling factors for the number of bidders that enable it to match benchmark performance. Remarkably, our findings break previously established worst-case impossibility results, underscoring the practical robustness and efficiency of posted pricing in large-scale marketplaces.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research employs theoretical analysis and real-world auction data to examine posted pricing mechanisms in large online marketplaces, focusing on allocation of a single unit and multiple units, and comparing fixed prices to posted prices.

Key Results

- In large markets, fixed pricing improves the known performance guarantee from $1-1/e\approx 0.632$ to $0.712$ for a single unit allocation.

- For selling $k$ identical units, the optimal fixed price guarantee approaches $1-1/\sqrt{2k \pi}$, indicating the large market advantage diminishes as $k$ increases.

- Under large market assumptions, competition complexity for optimal posted price mechanisms remains constant, with precise scaling factors identified for the number of bidders to match benchmark performance.

Significance

This research is important as it highlights the practical robustness and efficiency of posted pricing in large-scale marketplaces, breaking previous worst-case impossibility results and providing actionable insights for online marketplace design and management.

Technical Contribution

The paper presents novel performance guarantees for fixed pricing in large markets and demonstrates constant competition complexity for optimal posted price mechanisms under large market assumptions.

Novelty

This work distinguishes itself by providing improved performance guarantees for fixed pricing and revealing the constant competition complexity of optimal posted price mechanisms in large markets, challenging previous worst-case impossibility results.

Limitations

- The study assumes independent and identically distributed buyer valuations.

- Real-world marketplaces may exhibit more complex dynamics not fully captured by the model.

Future Work

- Investigate the performance of posted pricing mechanisms in markets with heterogeneous item values.

- Explore the impact of dynamic pricing strategies in large online marketplaces.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)