Summary

This paper studies a discrete-time optimal switching problem on a finite horizon. The underlying model has a running reward, terminal reward and signed (positive and negative) switching costs. Using the martingale approach to optimal stopping problems, we extend a well known explicit dynamic programming method for computing the value function and the optimal strategy to the case of signed switching costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

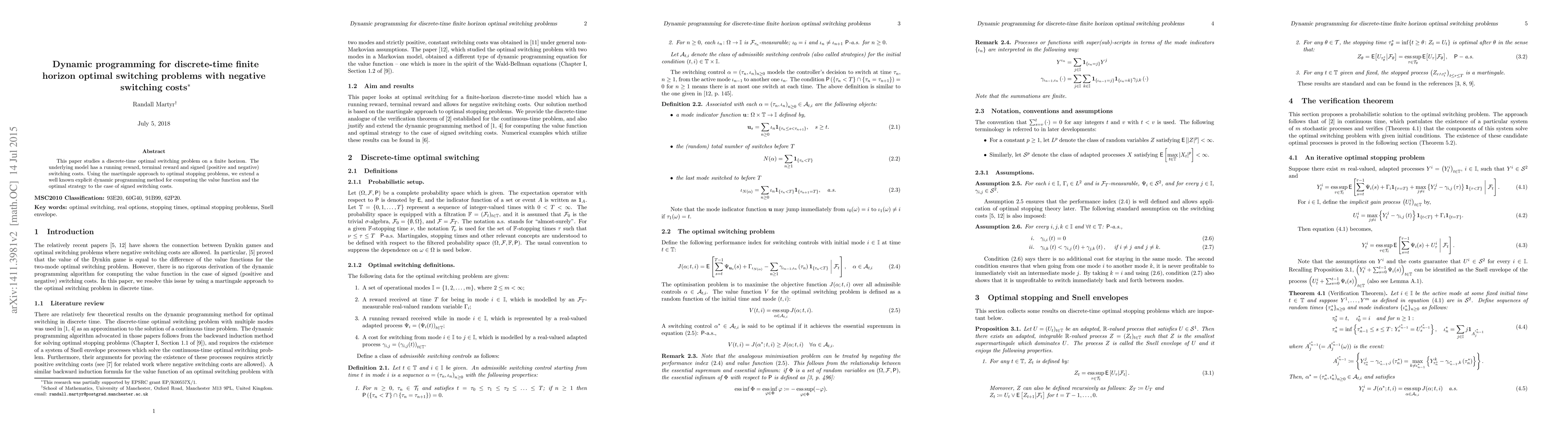

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiscrete-time risk-aware optimal switching with non-adapted costs

Magnus Perninge, John Moriarty, Randall Martyr

| Title | Authors | Year | Actions |

|---|

Comments (0)