Summary

This paper uses recent results on continuous-time finite-horizon optimal switching problems with negative switching costs to prove the existence of a saddle point in an optimal stopping (Dynkin) game. Sufficient conditions for the game's value to be continuous with respect to the time horizon are obtained using recent results on norm estimates for doubly reflected backward stochastic differential equations. This theory is then demonstrated numerically for the special cases of cancellable call and put options in a Black-Scholes market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

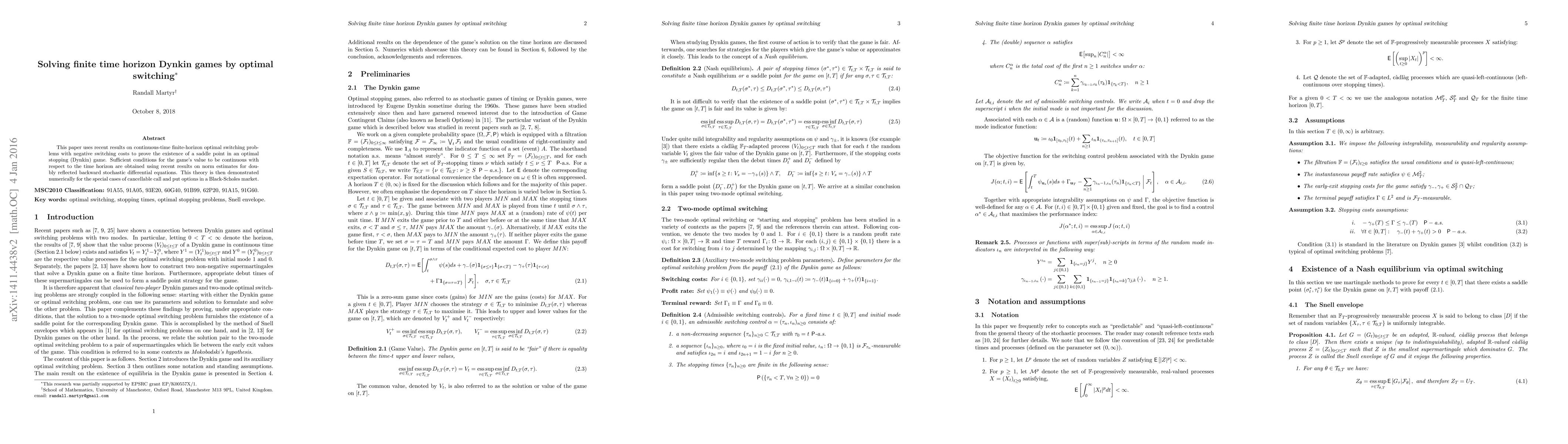

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)