Summary

The LIBOR rate is currently scheduled for discontinuation, and the replacement advocated by regulators in the US is the Secured Overnight Financing Rate (SOFR). The change has the potential to disrupt the $200 trillion market of derivatives and debt tied to the LIBOR. The only SOFR linked derivative with any significant liquidity and trading history is the SOFR futures contract, traded at the CME since 2018. We use the historical record of futures prices to construct dynamic arbitrage-free models for the SOFR term structure. The models allow you to construct forward-looking SOFR term rates, imply a SOFR discounting curve and price and risk and risk manage SOFR derivatives, not yet liquidly traded in the market. We find that a standard three-factor Gaussian arbitrage-free Nelson-Siegel model describes term rates very well but a shadow-rate extension is needed to describe the behaviour near the zero-boundary. We also find that the jumps and seasonal effects observed in SOFR, do not need to be specifically accounted for in a model for the futures prices. Finally we study the so-called convexity correction and find that it becomes significant beyond the 2 year maturity. For validation purposes we demonstrate that our model aligns closely with the methodology used by the Federal Reserve to publish indicative SOFR term rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

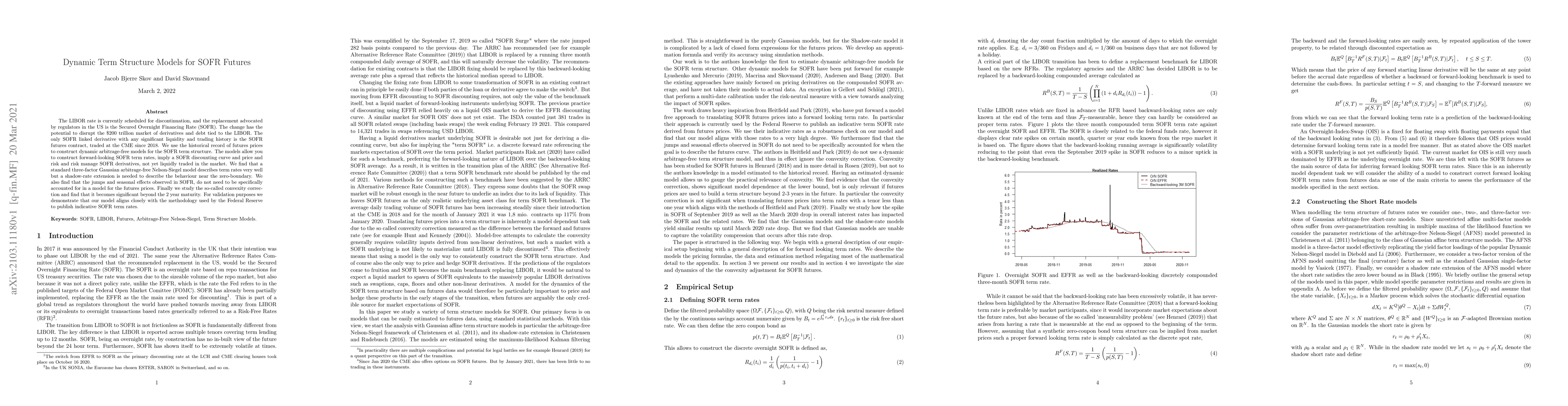

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemi-analytical pricing of options written on SOFR futures

Yerkin Kitapbayev, Andrey Itkin

Analytic Pricing of SOFR Futures Contracts with Smile and Skew

Aurelio Romero-Bermúdez, Colin Turfus

| Title | Authors | Year | Actions |

|---|

Comments (0)