Authors

Summary

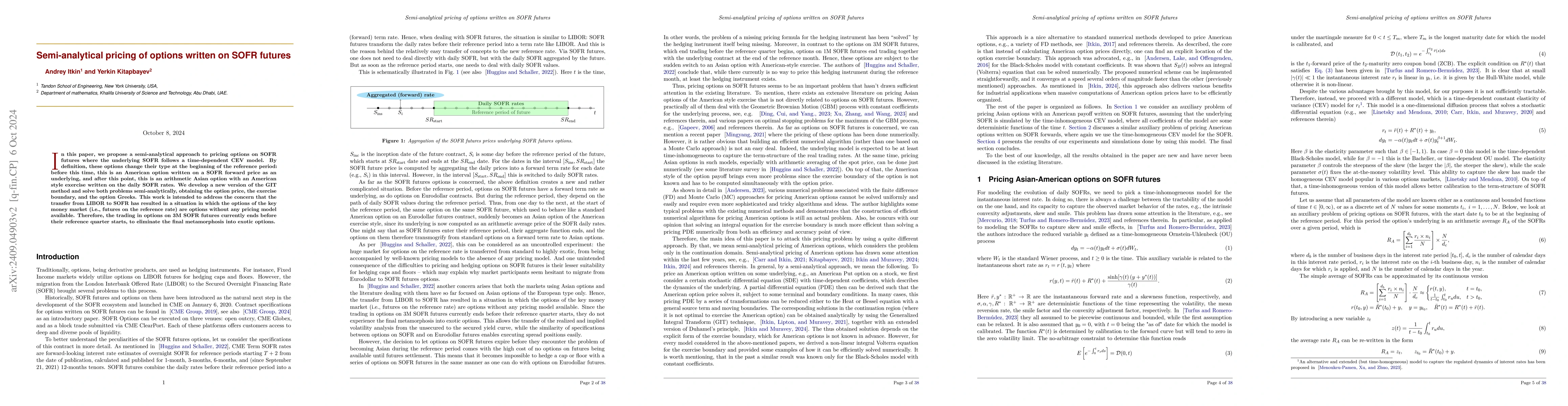

In this paper, we propose a semi-analytical approach to pricing options on SOFR futures where the underlying SOFR follows a time-dependent CEV model. By definition, these options change their type at the beginning of the reference period: before this time, this is an American option written on a SOFR forward price as an underlying, and after this point, this is an arithmetic Asian option with an American style exercise written on the daily SOFR rates. We develop a new version of the GIT method and solve both problems semi-analytically, obtaining the option price, the exercise boundary, and the option Greeks. This work is intended to address the concern that the transfer from LIBOR to SOFR has resulted in a situation in which the options of the key money market (i.e., futures on the reference rate) are options without any pricing model available. Therefore, the trading in options on 3M SOFR futures currently ends before their reference quarter starts, to eliminate the final metamorphosis into exotic options.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper proposes a semi-analytical approach to pricing options on SOFR futures, utilizing a time-dependent Constant Elasticity of Variance (CEV) model for the underlying SOFR. It develops a new version of the GIT method to solve both the American option problem before the reference period and the Asian option problem with an American exercise style after the reference period.

Key Results

- A semi-analytical solution for the option price, exercise boundary, and option Greeks is obtained.

- The approach addresses the lack of pricing models for options on SOFR futures, which previously led to trading halting before the reference quarter start.

- The method simplifies existing numerical complexities associated with pricing American and Asian options.

- The solution is applicable to time-inhomogeneous CEV models, with specific simplifications for the Hull-White model (β = -1).

Significance

This research is significant as it provides a pricing model for options on SOFR futures, which are crucial in the transition from LIBOR to SOFR. It ensures continuous trading of these options without the need for manual intervention at the start of each reference period.

Technical Contribution

The paper introduces a novel semi-analytical method for pricing American and Asian options on futures with a time-dependent CEV model, significantly reducing computational burden compared to traditional numerical methods.

Novelty

The novelty of this work lies in its semi-analytical approach to pricing complex financial derivatives, specifically addressing the gap in pricing models for SOFR futures options, and providing explicit solutions for exercise boundaries and Greeks.

Limitations

- The method assumes a specific underlying model (CEV with time-dependent parameters).

- The approach may not generalize well to other types of underlying processes or more complex models.

- Computational complexity could still be high for certain grid configurations.

Future Work

- Explore the applicability of this method to other underlying models and market instruments.

- Investigate methods to reduce computational complexity for broader applicability.

- Extend the analysis to include more exotic options and consider stochastic interest rates.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalytic Pricing of SOFR Futures Contracts with Smile and Skew

Aurelio Romero-Bermúdez, Colin Turfus

Pricing Carbon Allowance Options on Futures: Insights from High-Frequency Data

Giacomo Bormetti, Simone Serafini

| Title | Authors | Year | Actions |

|---|

Comments (0)