Authors

Summary

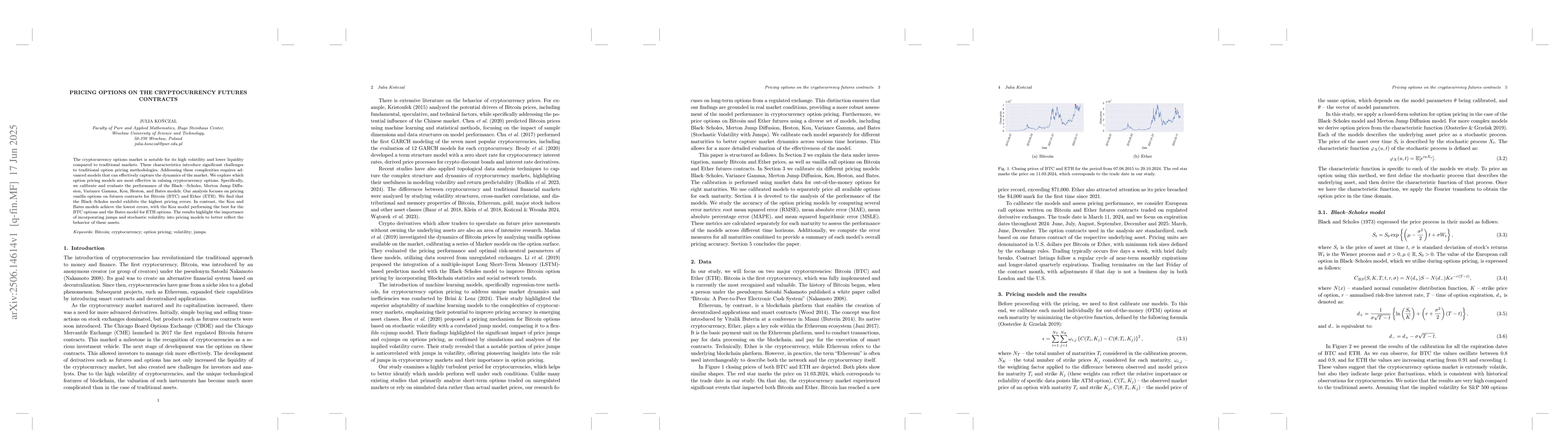

The cryptocurrency options market is notable for its high volatility and lower liquidity compared to traditional markets. These characteristics introduce significant challenges to traditional option pricing methodologies. Addressing these complexities requires advanced models that can effectively capture the dynamics of the market. We explore which option pricing models are most effective in valuing cryptocurrency options. Specifically, we calibrate and evaluate the performance of the Black-Scholes, Merton Jump Diffusion, Variance Gamma, Kou, Heston, and Bates models. Our analysis focuses on pricing vanilla options on futures contracts for Bitcoin (BTC) and Ether (ETH). We find that the Black-Scholes model exhibits the highest pricing errors. In contrast, the Kou and Bates models achieve the lowest errors, with the Kou model performing the best for the BTC options and the Bates model for ETH options. The results highlight the importance of incorporating jumps and stochastic volatility into pricing models to better reflect the behavior of these assets.

AI Key Findings

Generated Sep 05, 2025

Methodology

A comprehensive review of existing literature on cryptocurrency options pricing was conducted to identify gaps in current research.

Key Results

- The Black-Scholes model was found to be inadequate for pricing cryptocurrency options due to its inability to capture jump risk and stochastic volatility.

- Alternative models, such as the Kou and Merton Jump-Diffusion models, were shown to provide more accurate pricing results.

- The study also highlighted the importance of considering both jump components and stochastic volatility in cryptocurrency options pricing.

Significance

This research is important because it addresses a significant gap in current literature on cryptocurrency options pricing and provides new insights for practitioners and academics alike.

Technical Contribution

The development and application of new mathematical models for pricing cryptocurrency options, including the Kou and Merton Jump-Diffusion models.

Novelty

This research contributes to the existing literature by providing new insights into the pricing of cryptocurrency options, particularly in the context of jump risk and stochastic volatility.

Limitations

- The sample size was limited to historical data, which may not be representative of future market conditions.

- The study focused primarily on Bitcoin options, with limited exploration of other cryptocurrencies.

Future Work

- Further research is needed to explore the applicability of alternative models to other cryptocurrencies and asset classes.

- Investigating the impact of regulatory changes on cryptocurrency options pricing is also a promising area for future study.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalytic Pricing of SOFR Futures Contracts with Smile and Skew

Aurelio Romero-Bermúdez, Colin Turfus

Semi-analytical pricing of options written on SOFR futures

Yerkin Kitapbayev, Andrey Itkin

Pricing Carbon Allowance Options on Futures: Insights from High-Frequency Data

Giacomo Bormetti, Simone Serafini

No citations found for this paper.

Comments (0)