Authors

Summary

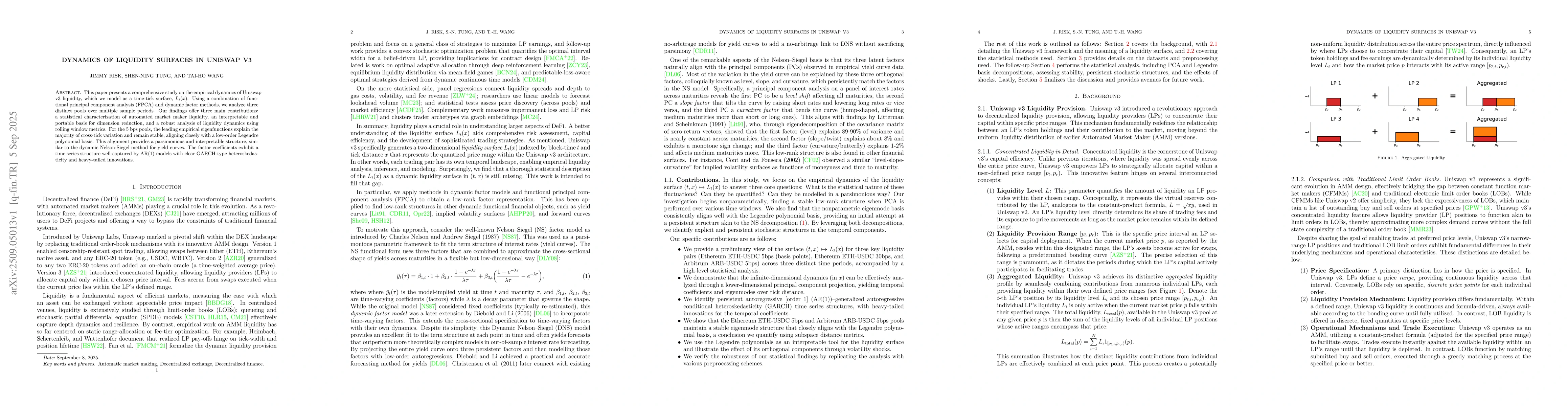

This paper presents a comprehensive study on the empirical dynamics of Uniswap v3 liquidity, which we model as a time-tick surface, $L_t(x)$. Using a combination of functional principal component analysis (FPCA) and dynamic factor methods, we analyze three distinct pools over multiple sample periods. Our findings offer three main contributions: a statistical characterization of automated market maker liquidity, an interpretable and portable basis for dimension reduction, and a robust analysis of liquidity dynamics using rolling window metrics. For the 5 bps pools, the leading empirical eigenfunctions explain the majority of cross-tick variation and remain stable, aligning closely with a low-order Legendre polynomial basis. This alignment provides a parsimonious and interpretable structure, similar to the dynamic Nelson-Siegel method for yield curves. The factor coefficients exhibit a time series structure well-captured by AR(1) models with clear GARCH-type heteroskedasticity and heavy-tailed innovations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRisks and Returns of Uniswap V3 Liquidity Providers

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

Strategic Liquidity Provision in Uniswap v3

David C. Parkes, Zhou Fan, Michael Neuder et al.

Differential Liquidity Provision in Uniswap v3 and Implications for Contract Design

David C. Parkes, He Sun, Xintong Wang et al.

Comments (0)