Summary

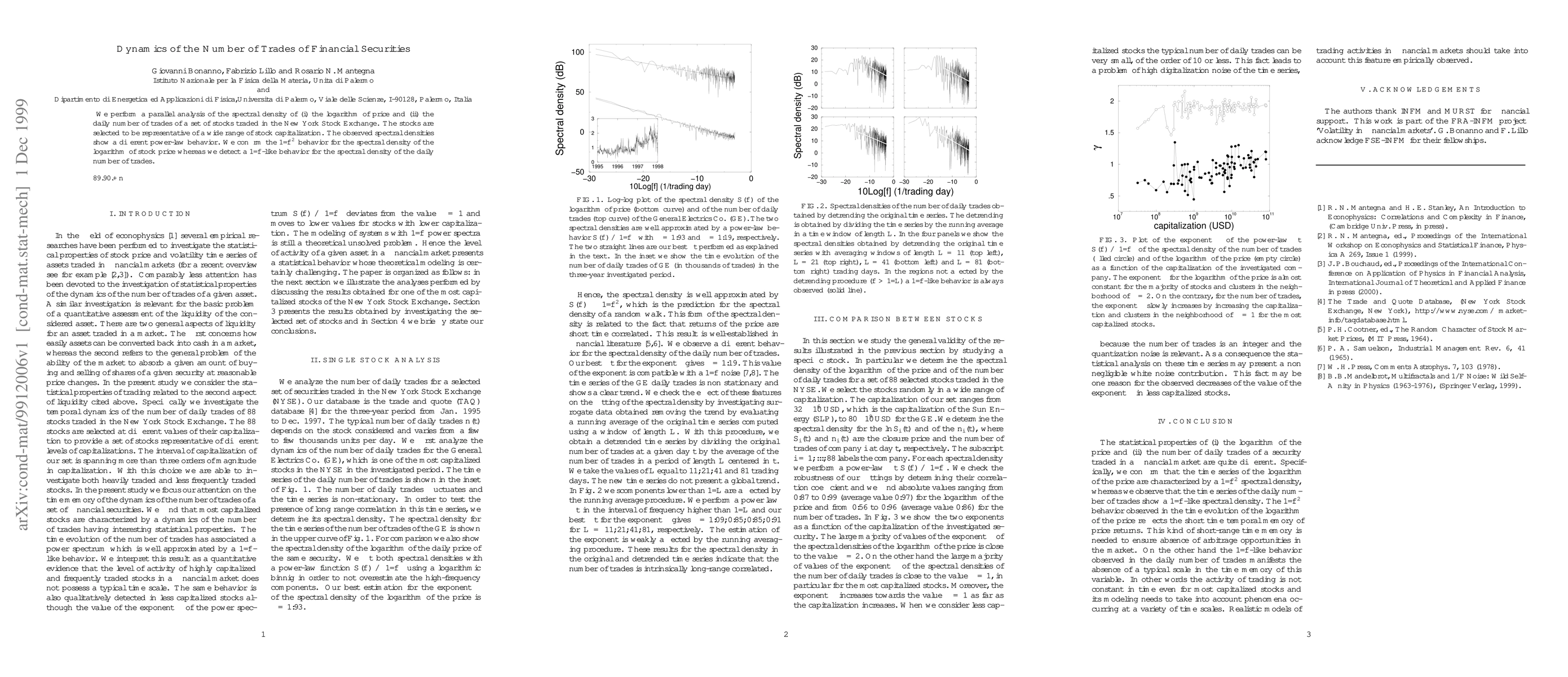

We perform a parallel analysis of the spectral density of (i) the logarithm of price and (ii) the daily number of trades of a set of stocks traded in the New York Stock Exchange. The stocks are selected to be representative of a wide range of stock capitalization. The observed spectral densities show a different power-law behavior. We confirm the $1/f^2$ behavior for the spectral density of the logarithm of stock price whereas we detect a $1/f$-like behavior for the spectral density of the daily number of trades.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Structure, Firm Size and Financial Growth of Non-Financial Firms Listed at the Nairobi Securities Exchange

David Haritone Shikumo, Oluoch Oluoch, Joshua Matanda Wepukhulu

| Title | Authors | Year | Actions |

|---|

Comments (0)