Summary

We study an agent-based model of evolution of wealth distribution in a macro-economic system. The evolution is driven by multiplicative stochastic fluctuations governed by the law of proportionate growth and interactions between agents. We are mainly interested in interactions increasing wealth inequality that is in a local implementation of the accumulated advantage principle. Such interactions destabilise the system. They are confronted in the model with a global regulatory mechanism which reduces wealth inequality. There are different scenarios emerging as a net effect of these two competing mechanisms. When the effect of the global regulation (economic interventionism) is too weak the system is unstable and it never reaches equilibrium. When the effect is sufficiently strong the system evolves towards a limiting stationary distribution with a Pareto tail. In between there is a critical phase. In this phase the system may evolve towards a steady state with a multimodal wealth distribution. The corresponding cumulative density function has a characteristic stairway pattern which reflects the effect of economic stratification. The stairs represent wealth levels of economic classes separated by wealth gaps. As we show, the pattern is typical for macro-economic systems with a limited economic freedom. One can find such a multimodal pattern in empirical data, for instance, in the highest percentile of wealth distribution for the population in urban areas of China.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

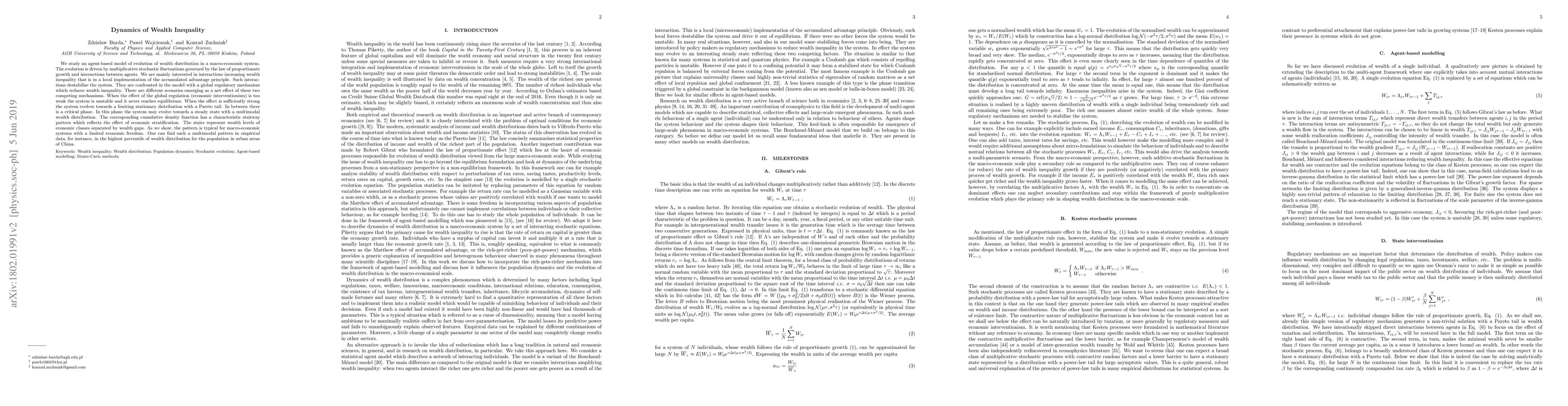

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatistical Dynamics of Wealth Inequality in Stochastic Models of Growth

Luis M. A. Bettencourt, Jordan T. Kemp

| Title | Authors | Year | Actions |

|---|

Comments (0)