Authors

Summary

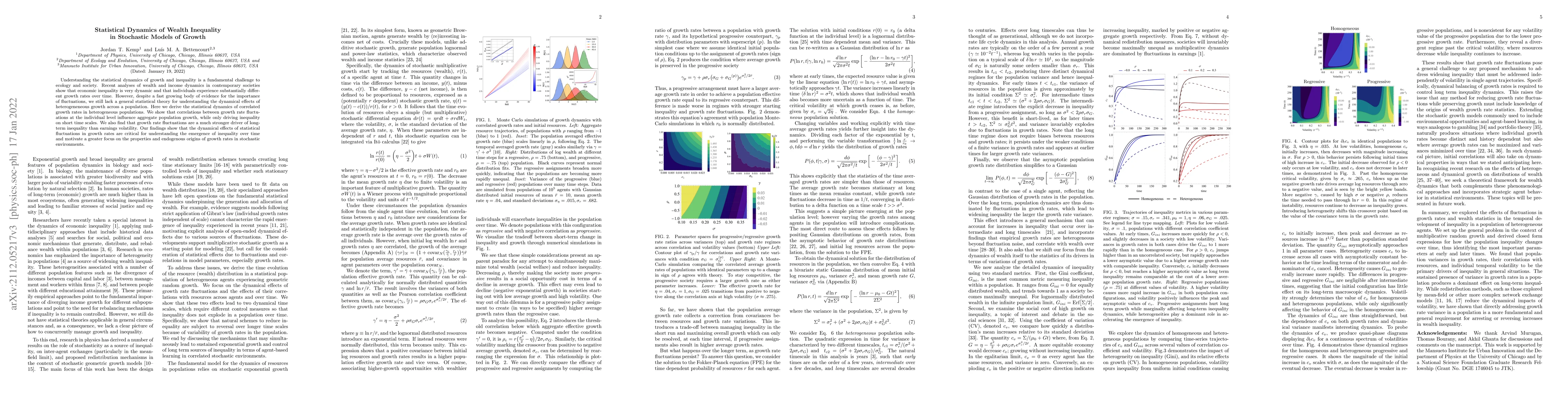

Understanding the statistical dynamics of growth and inequality is a fundamental challenge to ecology and society. Recent analyses of wealth and income dynamics in contemporary societies show that economic inequality is very dynamic and that individuals experience substantially different growth rates over time. However, despite a fast growing body of evidence for the importance of fluctuations, we still lack a general statistical theory for understanding the dynamical effects of heterogeneneous growth across a population. Here we derive the statistical dynamics of correlated growth rates in heterogeneous populations. We show that correlations between growth rate fluctuations at the individual level influence aggregate population growth, while only driving inequality on short time scales. We also find that growth rate fluctuations are a much stronger driver of long-term inequality than earnings volatility. Our findings show that the dynamical effects of statistical fluctuations in growth rates are critical for understanding the emergence of inequality over time and motivate a greater focus on the properties and endogenous origins of growth rates in stochastic environments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)