Summary

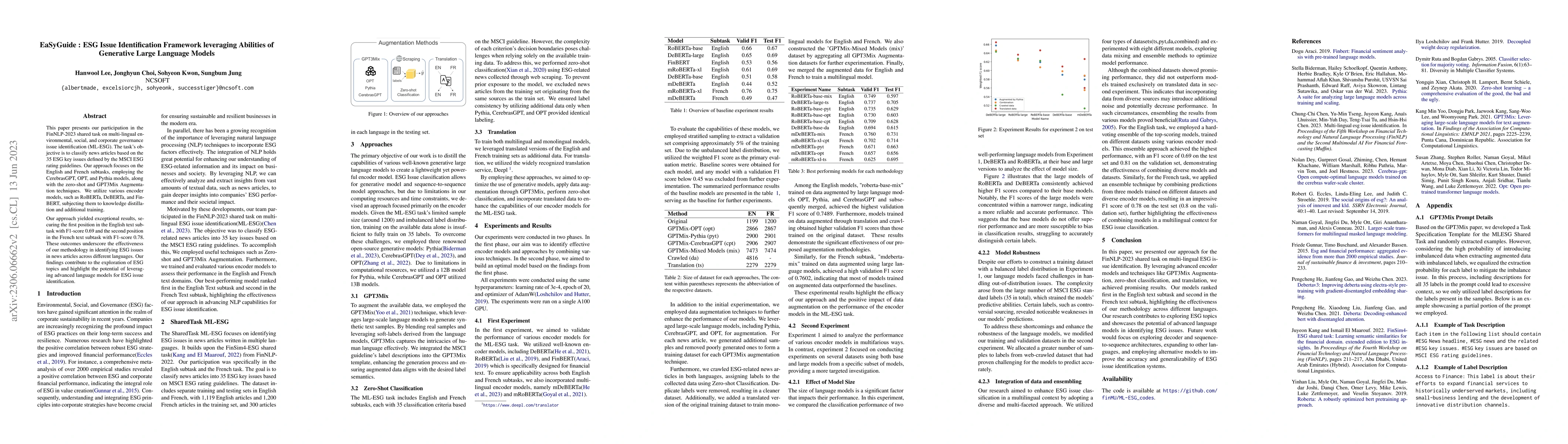

This paper presents our participation in the FinNLP-2023 shared task on multi-lingual environmental, social, and corporate governance issue identification (ML-ESG). The task's objective is to classify news articles based on the 35 ESG key issues defined by the MSCI ESG rating guidelines. Our approach focuses on the English and French subtasks, employing the CerebrasGPT, OPT, and Pythia models, along with the zero-shot and GPT3Mix Augmentation techniques. We utilize various encoder models, such as RoBERTa, DeBERTa, and FinBERT, subjecting them to knowledge distillation and additional training. Our approach yielded exceptional results, securing the first position in the English text subtask with F1-score 0.69 and the second position in the French text subtask with F1-score 0.78. These outcomes underscore the effectiveness of our methodology in identifying ESG issues in news articles across different languages. Our findings contribute to the exploration of ESG topics and highlight the potential of leveraging advanced language models for ESG issue identification.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research employs various encoder models like RoBERTa, DeBERTa, and FinBERT, subjecting them to knowledge distillation and additional training. It also uses zero-shot and GPT3Mix augmentation techniques with CerebrasGPT, OPT, and Pythia models for ESG issue identification in English and French news articles.

Key Results

- Secured the first position in the English text subtask with an F1-score of 0.69.

- Ranked second in the French text subtask with an F1-score of 0.78.

- Large models of RoBERTa and DeBERTa consistently achieved higher F1 scores compared to their base versions.

- An ensemble approach combining predictions from diverse models and datasets yielded the highest performance, with an F1 score of 0.69 on the English task and 0.78 on the French task.

- Data augmentation techniques, including GPT3Mix, zero-shot classification, and translation, significantly improved model performance.

Significance

This research highlights the potential of leveraging advanced language models for ESG issue identification in multilingual contexts, contributing to the exploration of ESG topics and providing a framework for future studies.

Technical Contribution

The EaSyGuide framework effectively utilizes generative large language models for ESG issue identification, demonstrating the effectiveness of knowledge distillation, zero-shot classification, and data augmentation techniques.

Novelty

This work distinguishes itself by focusing on the distillation of generative large language models into lightweight yet powerful encoder models for ESG issue identification, showcasing the potential of advanced language models in multilingual contexts.

Limitations

- Limited by computational resources and time constraints, the approach primarily focused on encoder models.

- The ML-ESG task's limited sample size (around 1200) and imbalanced label distribution posed challenges for training.

- Certain ESG labels, like controversial sourcing, revealed noticeable weaknesses in the models' predictions.

Future Work

- Explore decoder and sequence-to-sequence architectures for ESG issue identification.

- Expand the approach to other languages.

- Employ alternative models to improve the accuracy and generalizability of ESG issue identification systems.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeveraging BERT Language Models for Multi-Lingual ESG Issue Identification

Elvys Linhares Pontes, Mohamed Benjannet, Lam Kim Ming

Emergent Abilities of Large Language Models

Oriol Vinyals, Jeff Dean, Sebastian Borgeaud et al.

Bridging Bug Localization and Issue Fixing: A Hierarchical Localization Framework Leveraging Large Language Models

David Lo, Xin Zhou, Lulu Wang et al.

Leveraging Open-Source Large Language Models for Native Language Identification

Ilia Markov, Yee Man Ng

| Title | Authors | Year | Actions |

|---|

Comments (0)