Summary

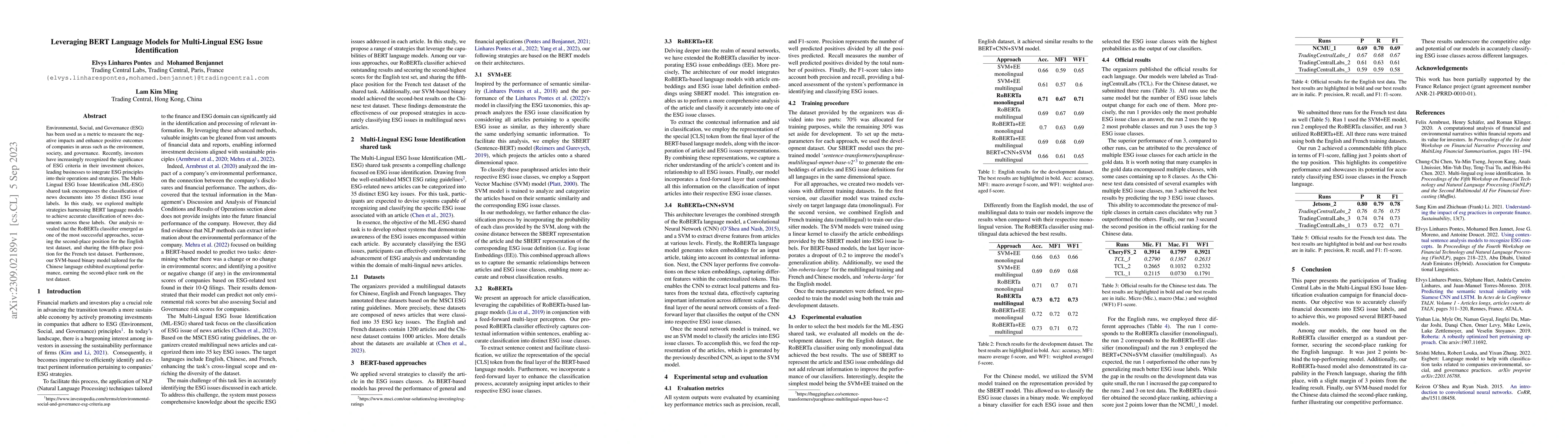

Environmental, Social, and Governance (ESG) has been used as a metric to measure the negative impacts and enhance positive outcomes of companies in areas such as the environment, society, and governance. Recently, investors have increasingly recognized the significance of ESG criteria in their investment choices, leading businesses to integrate ESG principles into their operations and strategies. The Multi-Lingual ESG Issue Identification (ML-ESG) shared task encompasses the classification of news documents into 35 distinct ESG issue labels. In this study, we explored multiple strategies harnessing BERT language models to achieve accurate classification of news documents across these labels. Our analysis revealed that the RoBERTa classifier emerged as one of the most successful approaches, securing the second-place position for the English test dataset, and sharing the fifth-place position for the French test dataset. Furthermore, our SVM-based binary model tailored for the Chinese language exhibited exceptional performance, earning the second-place rank on the test dataset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEaSyGuide : ESG Issue Identification Framework leveraging Abilities of Generative Large Language Models

Jonghyun Choi, Hanwool Lee, Sohyeon Kwon et al.

BERT-LID: Leveraging BERT to Improve Spoken Language Identification

Wei-Qiang Zhang, Jinfeng Bai, Junhong Zhao et al.

Leveraging Natural Language and Item Response Theory Models for ESG Scoring

César Pedrosa Soares

| Title | Authors | Year | Actions |

|---|

Comments (0)