Authors

Summary

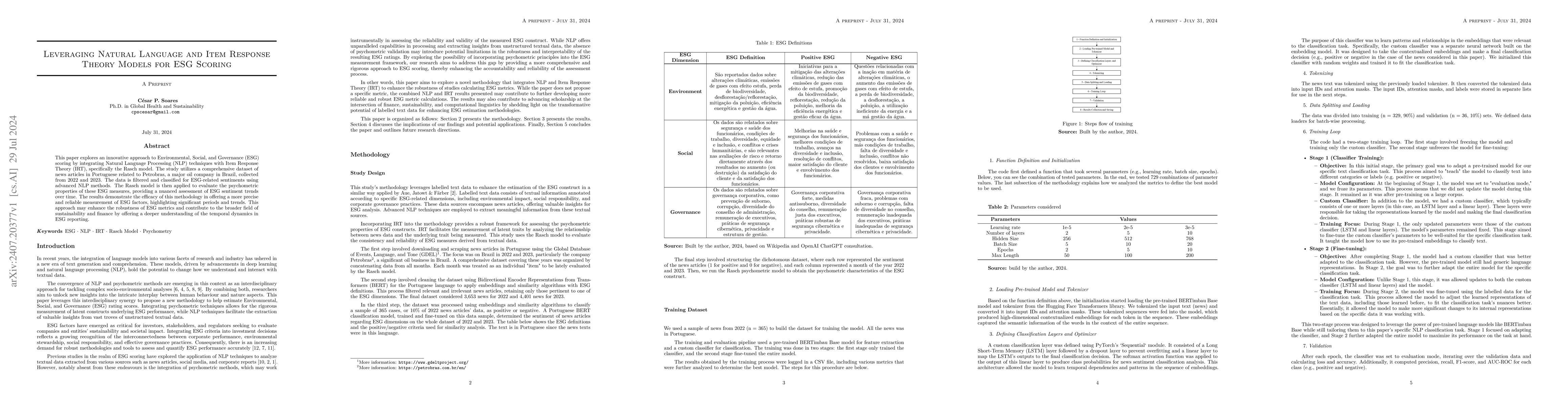

This paper explores an innovative approach to Environmental, Social, and Governance (ESG) scoring by integrating Natural Language Processing (NLP) techniques with Item Response Theory (IRT), specifically the Rasch model. The study utilizes a comprehensive dataset of news articles in Portuguese related to Petrobras, a major oil company in Brazil, collected from 2022 and 2023. The data is filtered and classified for ESG-related sentiments using advanced NLP methods. The Rasch model is then applied to evaluate the psychometric properties of these ESG measures, providing a nuanced assessment of ESG sentiment trends over time. The results demonstrate the efficacy of this methodology in offering a more precise and reliable measurement of ESG factors, highlighting significant periods and trends. This approach may enhance the robustness of ESG metrics and contribute to the broader field of sustainability and finance by offering a deeper understanding of the temporal dynamics in ESG reporting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeveraging BERT Language Models for Multi-Lingual ESG Issue Identification

Elvys Linhares Pontes, Mohamed Benjannet, Lam Kim Ming

EaSyGuide : ESG Issue Identification Framework leveraging Abilities of Generative Large Language Models

Jonghyun Choi, Hanwool Lee, Sohyeon Kwon et al.

Lost in Benchmarks? Rethinking Large Language Model Benchmarking with Item Response Theory

Hui Huang, Wei Bao, Bing Xu et al.

No citations found for this paper.

Comments (0)