Authors

Summary

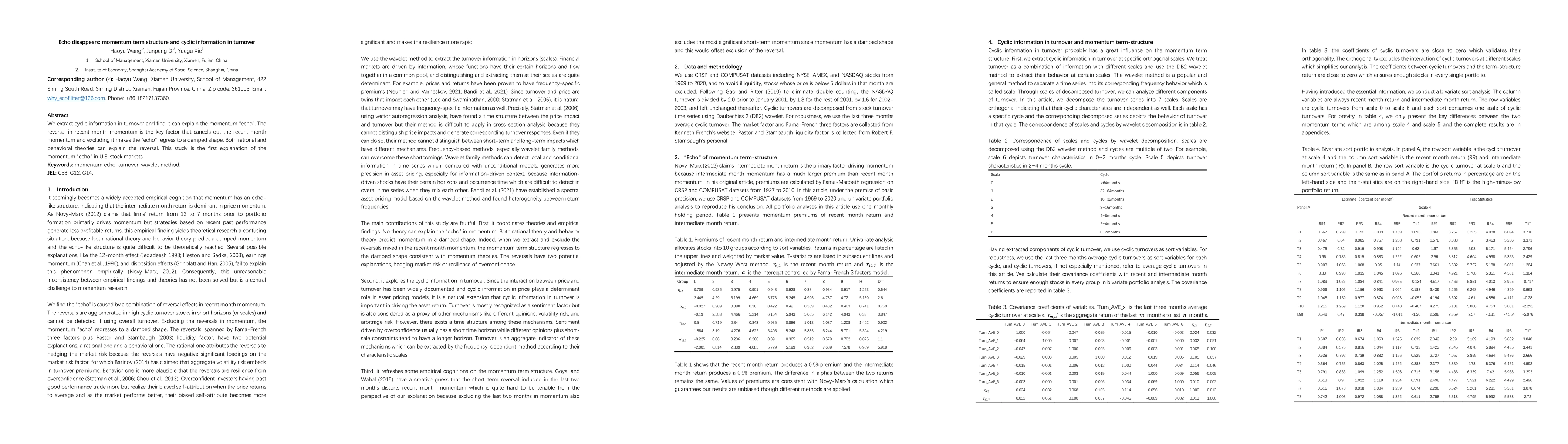

We extract cyclic information in turnover and find it can explain the momentum echo. The reversal in recent month momentum is the key factor that cancels out the recent month momentum and excluding it makes the echo regress to a damped shape. Both rational and behavioral theories can explain the reversal. This study is the first explanation of the momentum echo in U.S. stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLoschmidt echo and Momentum Distribution in a Kitaev Spin Chain

Vimalesh Kumar Vimal, V. Subrahmanyam, H. Wanare

Generalized Loschmidt echo and information scrambling in open systems

Chang Liu, Yi-Neng Zhou

No citations found for this paper.

Comments (0)