Summary

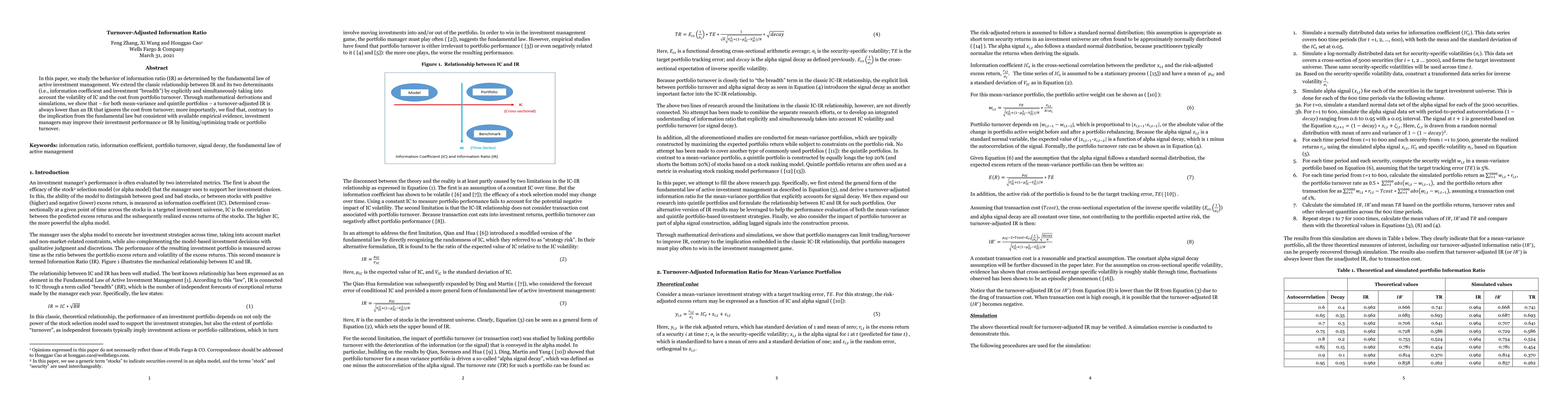

In this paper, we study the behavior of information ratio (IR) as determined by the fundamental law of active investment management. We extend the classic relationship between IR and its two determinants (i.e., information coefficient and investment "breadth") by explicitly and simultaneously taking into account the volatility of IC and the cost from portfolio turnover. Through mathematical derivations and simulations, we show that - for both mean-variance and quintile portfolios - a turnover-adjusted IR is always lower than an IR that ignores the cost from turnover; more importantly, we find that, contrary to the implication from the fundamental low but consistent with available empirical evidence, investment managers may improve their investment performance or IR by limiting/optimizing trade or portfolio turnover.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Turnover, Liquidity, and Autocorrelation

Bastien Baldacci, Jerome Benveniste, Gordon Ritter

No citations found for this paper.

Comments (0)