Summary

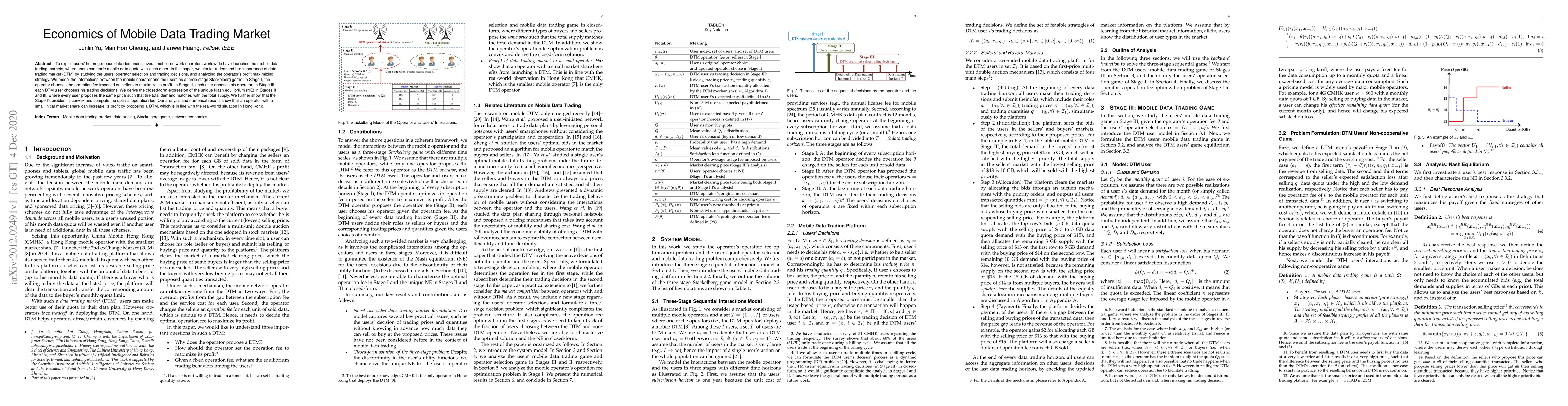

To exploit users' heterogeneous data demands, several mobile network operators worldwide have launched the mobile data trading markets, where users can trade mobile data quota with each other. In this paper, we aim to understand the importance of data trading market (DTM) by studying the users' operator selection and trading decisions, and analyzing the operator's profit maximizing strategy. We model the interactions between the mobile operator and the users as a three-stage Stackelberg game. In Stage I, the operator chooses the operation fee imposed on sellers to maximize its profit. In Stage II, each user chooses his operator. In Stage III, each DTM user chooses his trading decisions. We derive the closed-form expression of the unique Nash equilibrium (NE) in Stages II and III, where every user proposes the same price such that the total demand matches with the total supply. We further show that the Stage I's problem is convex and compute the optimal operation fee. Our analysis and numerical results show that an operator with a small initial market share can increase its profit by proposing a DTM, which is in line with the real-world situation in Hong Kong.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)