Summary

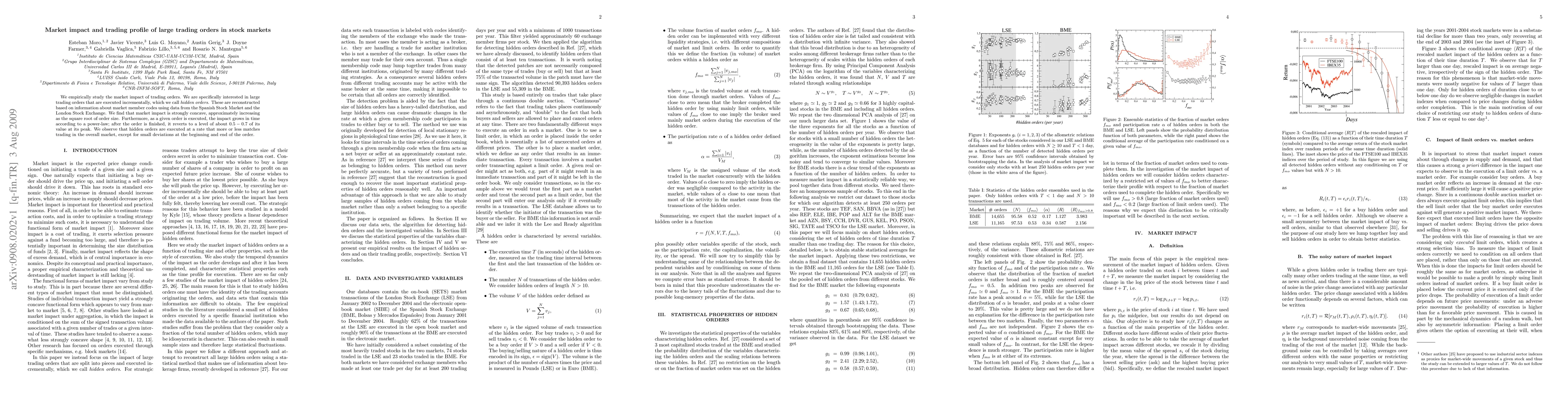

We empirically study the market impact of trading orders. We are specifically interested in large trading orders that are executed incrementally, which we call hidden orders. These are reconstructed based on information about market member codes using data from the Spanish Stock Market and the London Stock Exchange. We find that market impact is strongly concave, approximately increasing as the square root of order size. Furthermore, as a given order is executed, the impact grows in time according to a power-law; after the order is finished, it reverts to a level of about 0.5-0.7 of its value at its peak. We observe that hidden orders are executed at a rate that more or less matches trading in the overall market, except for small deviations at the beginning and end of the order.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)