Summary

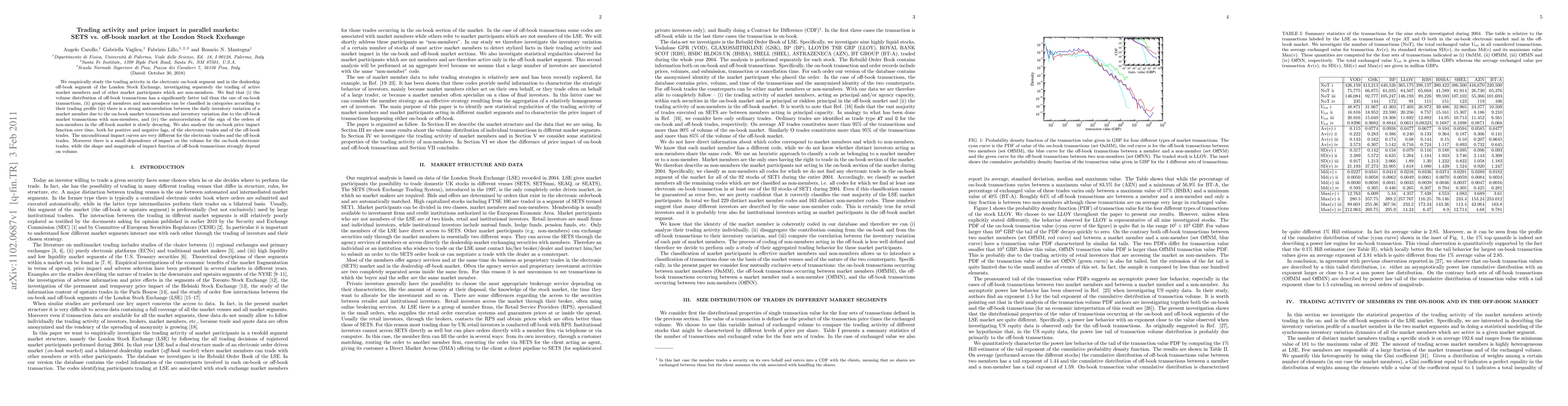

We empirically study the trading activity in the electronic on-book segment and in the dealership off-book segment of the London Stock Exchange, investigating separately the trading of active market members and of other market participants which are non-members. We find that (i) the volume distribution of off-book transactions has a significantly fatter tail than the one of on-book transactions, (ii) groups of members and non-members can be classified in categories according to their trading profile (iii) there is a strong anticorrelation between the daily inventory variation of a market member due to the on-book market transactions and inventory variation due to the off-book market transactions with non-members, and (iv) the autocorrelation of the sign of the orders of non-members in the off-book market is slowly decaying. We also analyze the on-book price impact function over time, both for positive and negative lags, of the electronic trades and of the off-book trades. The unconditional impact curves are very different for the electronic trades and the off-book trades. Moreover there is a small dependence of impact on the volume for the on-book electronic trades, while the shape and magnitude of impact function of off-book transactions strongly depend on volume.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)