Summary

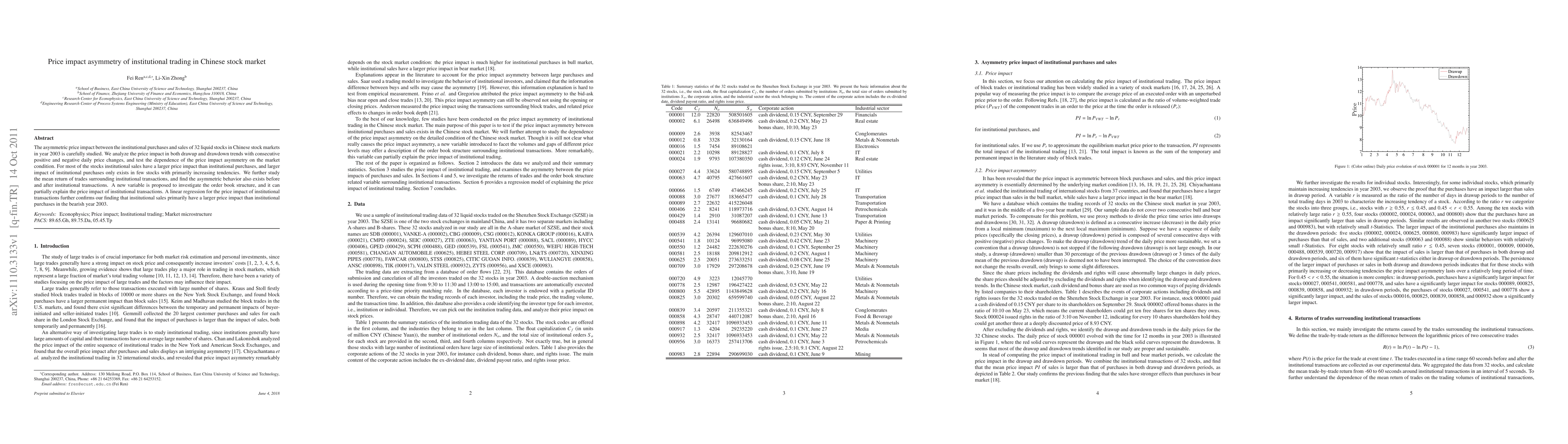

The asymmetric price impact between the institutional purchases and sales of 32 liquid stocks in Chinese stock markets in year 2003 is carefully studied. We analyze the price impact in both drawup and drawdown trends with consecutive positive and negative daily price changes, and test the dependence of the price impact asymmetry on the market condition. For most of the stocks institutional sales have a larger price impact than institutional purchases, and larger impact of institutional purchases only exists in few stocks with primarily increasing tendencies. We further study the mean return of trades surrounding institutional transactions, and find the asymmetric behavior also exists before and after institutional transactions. A new variable is proposed to investigate the order book structure, and it can partially explain the price impact of institutional transactions. A linear regression for the price impact of institutional transactions further confirms our finding that institutional sales primarily have a larger price impact than institutional purchases in the bearish year 2003.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)