Summary

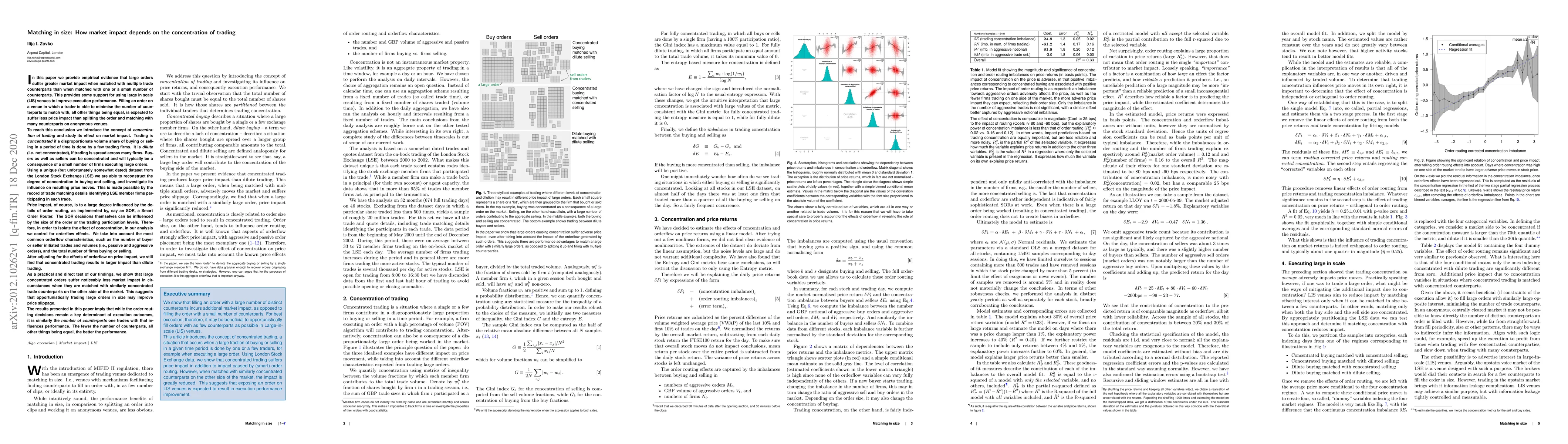

We show that filling an order with a large number of distinct counterparts incurs additional market impact, as opposed to filling the order with a small number of counterparts. For best execution, therefore, it may be beneficial to opportunistically fill orders with as few counterparts as possible in Large-in-scale (LIS) venues. This article introduces the concept of concentrated trading, a situation that occurs when a large fraction of buying or selling in a given time period is done by one or a few traders, for example when executing a large order. Using London Stock Exchange data, we show that concentrated trading suffers price impact in addition to impact caused by (smart) order routing. However, when matched with similarly concentrated counterparts on the other side of the market, the impact is greatly reduced. This suggests that exposing an order on LIS venues is expected to result in execution performance improvement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)