Summary

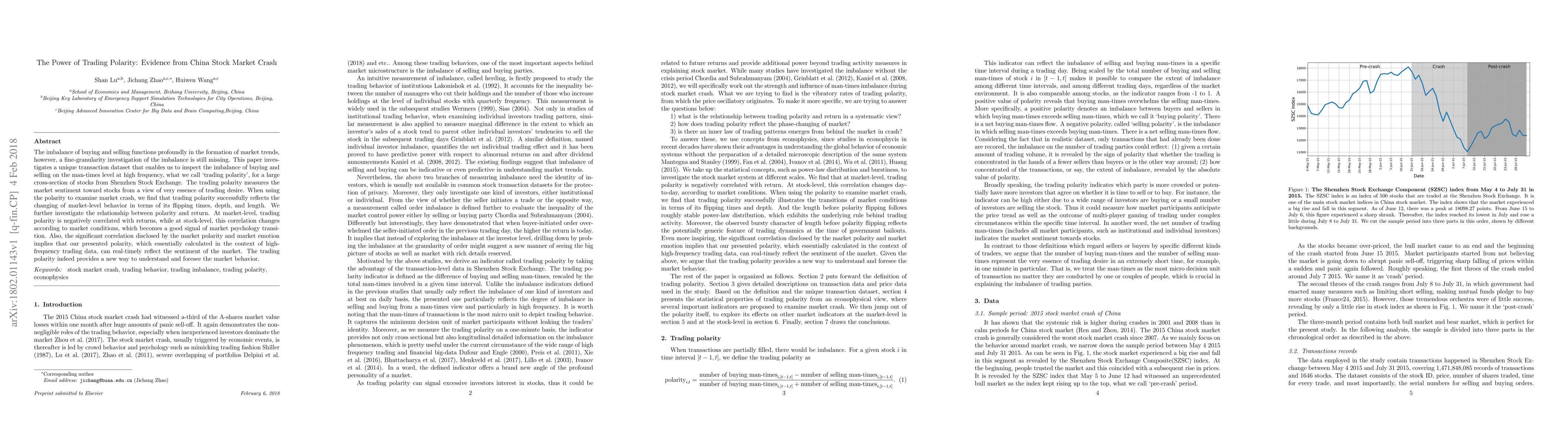

The imbalance of buying and selling functions profoundly in the formation of market trends, however, a fine-granularity investigation of the imbalance is still missing. This paper investigates a unique transaction dataset that enables us to inspect the imbalance of buying and selling on the man-times level at high frequency, what we call 'trading polarity', for a large cross-section of stocks from Shenzhen Stock Exchange. The trading polarity measures the market sentiment toward stocks from a view of very essence of trading desire. When using the polarity to examine market crash, we find that trading polarity successfully reflects the changing of market-level behavior in terms of its flipping times, depth, and length. We further investigate the relationship between polarity and return. At market-level, trading polarity is negatively correlated with returns, while at stock-level, this correlation changes according to market conditions, which becomes a good signal of market psychology transition. Also, the significant correlation disclosed by the market polarity and market emotion implies that our presented polarity, which essentially calculated in the context of high-frequency trading data, can real-timely reflect the sentiment of the market. The trading polarity indeed provides a new way to understand and foresee the market behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)