Summary

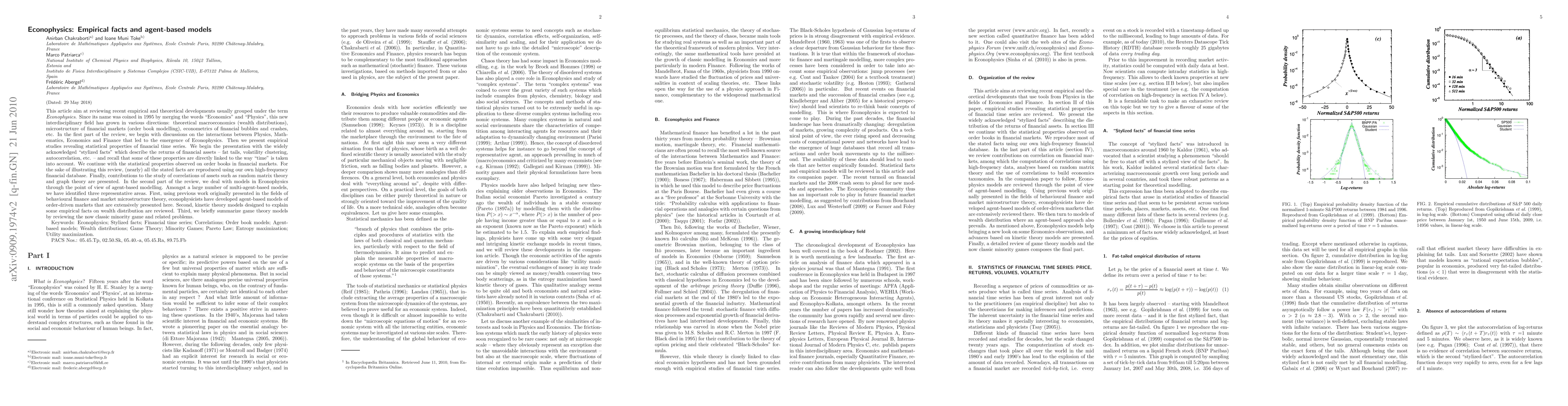

This article aims at reviewing recent empirical and theoretical developments usually grouped under the term Econophysics. Since its name was coined in 1995 by merging the words Economics and Physics, this new interdisciplinary field has grown in various directions: theoretical macroeconomics (wealth distributions), microstructure of financial markets (order book modelling), econometrics of financial bubbles and crashes, etc. In the first part of the review, we discuss on the emergence of Econophysics. Then we present empirical studies revealing statistical properties of financial time series. We begin the presentation with the widely acknowledged stylized facts which describe the returns of financial assets- fat tails, volatility clustering, autocorrelation, etc.- and recall that some of these properties are directly linked to the way time is taken into account. We continue with the statistical properties observed on order books in financial markets. For the sake of illustrating this review, (nearly) all the stated facts are reproduced using our own high-frequency financial database. Finally, contributions to the study of correlations of assets such as random matrix theory and graph theory are presented. In the second part of the review, we deal with models in Econophysics through the point of view of agent-based modelling. Amongst a large number of multi-agent-based models, we have identified three representative areas. First, using previous work originally presented in the fields of behavioural finance and market microstructure theory, econophysicists have developed agent-based models of order-driven markets that are extensively presented here. Second, kinetic theory models designed to explain some empirical facts on wealth distribution are reviewed. Third, we briefly summarize game theory models by reviewing the now classic minority game and related problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)