Summary

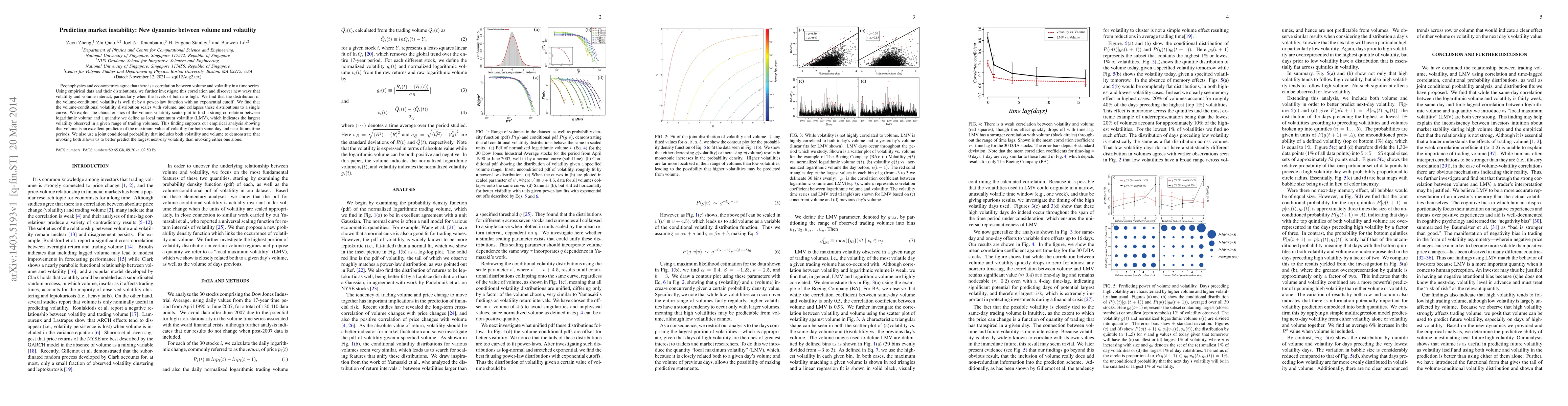

Econophysics and econometrics agree that there is a correlation between volume and volatility in a time series. Using empirical data and their distributions, we further investigate this correlation and discover new ways that volatility and volume interact, particularly when the levels of both are high. We find that the distribution of the volume-conditional volatility is well fit by a power-law function with an exponential cutoff. We find that the volume-conditional volatility distribution scales with volume, and collapses these distributions to a single curve. We exploit the characteristics of the volume-volatility scatter plot to find a strong correlation between logarithmic volume and a quantity we define as local maximum volatility (LMV), which indicates the largest volatility observed in a given range of trading volumes. This finding supports our empirical analysis showing that volume is an excellent predictor of the maximum value of volatility for both same-day and near-future time periods. We also use a joint conditional probability that includes both volatility and volume to demonstrate that invoking both allows us to better predict the largest next-day volatility than invoking either one alone.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)