Summary

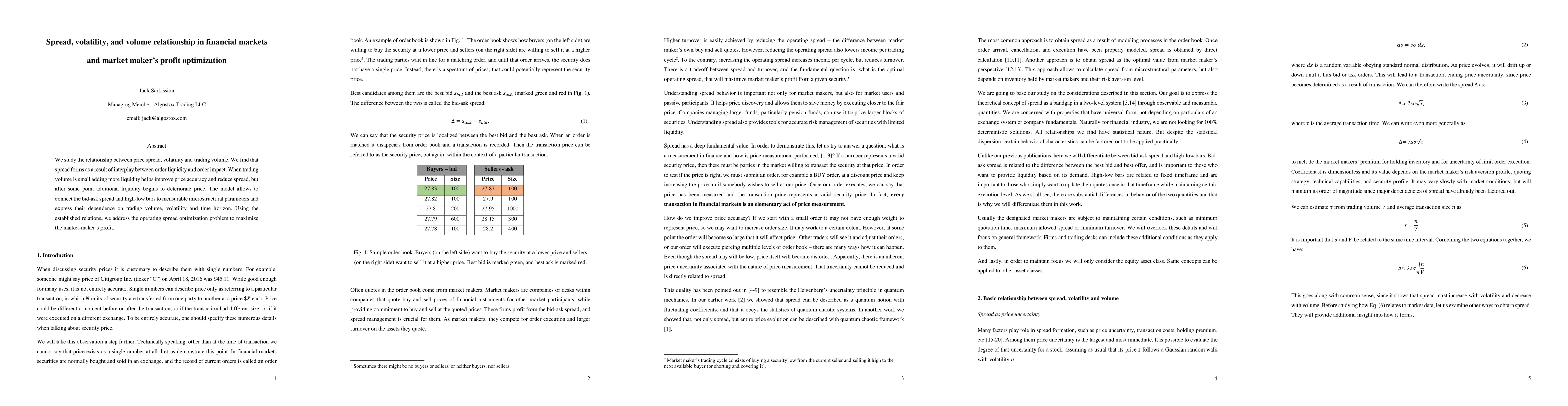

We study the relationship between price spread, volatility and trading volume. We find that spread forms as a result of interplay between order liquidity and order impact. When trading volume is small adding more liquidity helps improve price accuracy and reduce spread, but after some point additional liquidity begins to deteriorate price. The model allows to connect the bid-ask spread and high-low bars to measurable microstructural parameters and express their dependence on trading volume, volatility and time horizon. Using the established relations, we address the operating spread optimization problem to maximize market-making profit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)