Summary

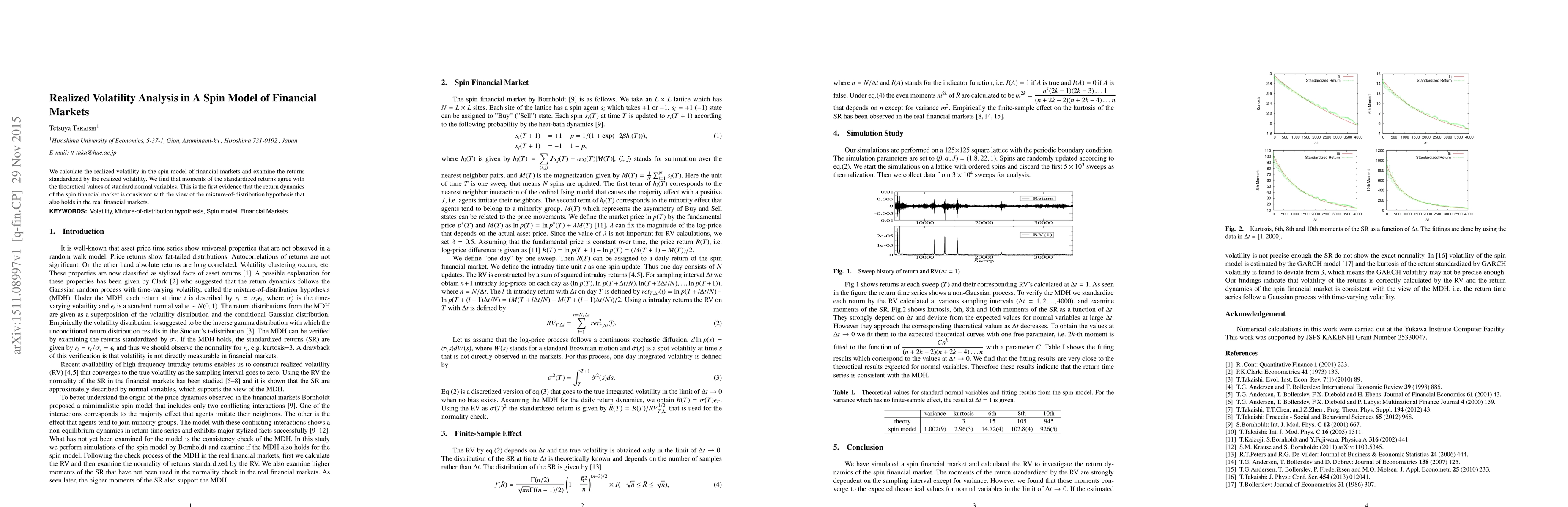

We calculate the realized volatility in the spin model of financial markets and examine the returns standardized by the realized volatility. We find that moments of the standardized returns agree with the theoretical values of standard normal variables. This is the first evidence that the return dynamics of the spin financial market is consistent with the view of the mixture-of-distribution hypothesis that also holds in the real financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)