Authors

Summary

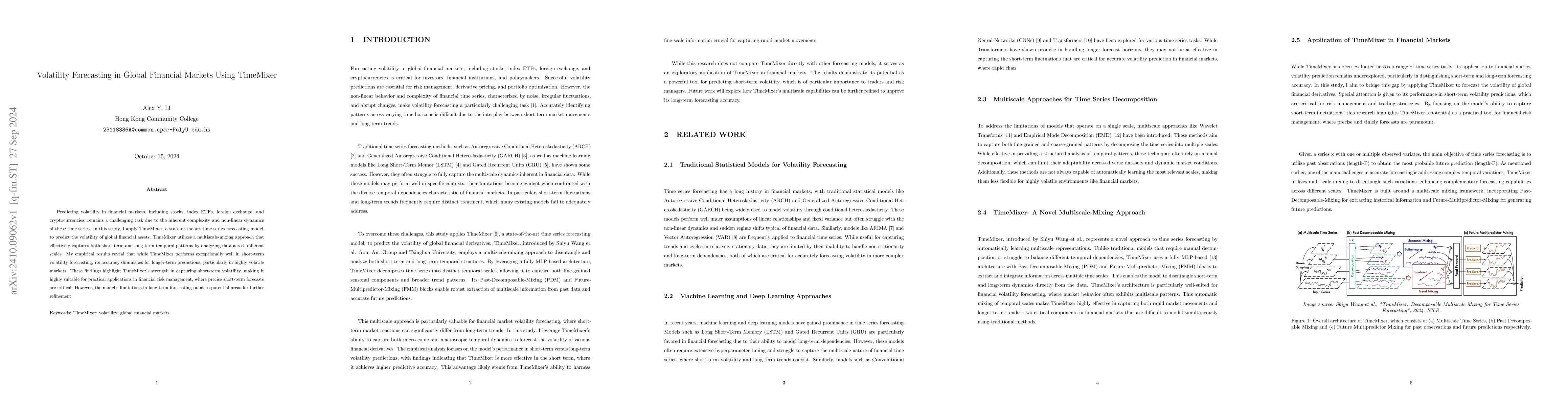

Predicting volatility in financial markets, including stocks, index ETFs, foreign exchange, and cryptocurrencies, remains a challenging task due to the inherent complexity and non-linear dynamics of these time series. In this study, I apply TimeMixer, a state-of-the-art time series forecasting model, to predict the volatility of global financial assets. TimeMixer utilizes a multiscale-mixing approach that effectively captures both short-term and long-term temporal patterns by analyzing data across different scales. My empirical results reveal that while TimeMixer performs exceptionally well in short-term volatility forecasting, its accuracy diminishes for longer-term predictions, particularly in highly volatile markets. These findings highlight TimeMixer's strength in capturing short-term volatility, making it highly suitable for practical applications in financial risk management, where precise short-term forecasts are critical. However, the model's limitations in long-term forecasting point to potential areas for further refinement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic graph neural networks for enhanced volatility prediction in financial markets

Nneka Umeorah, Pulikandala Nithish Kumar, Alex Alochukwu

No citations found for this paper.

Comments (0)