Authors

Summary

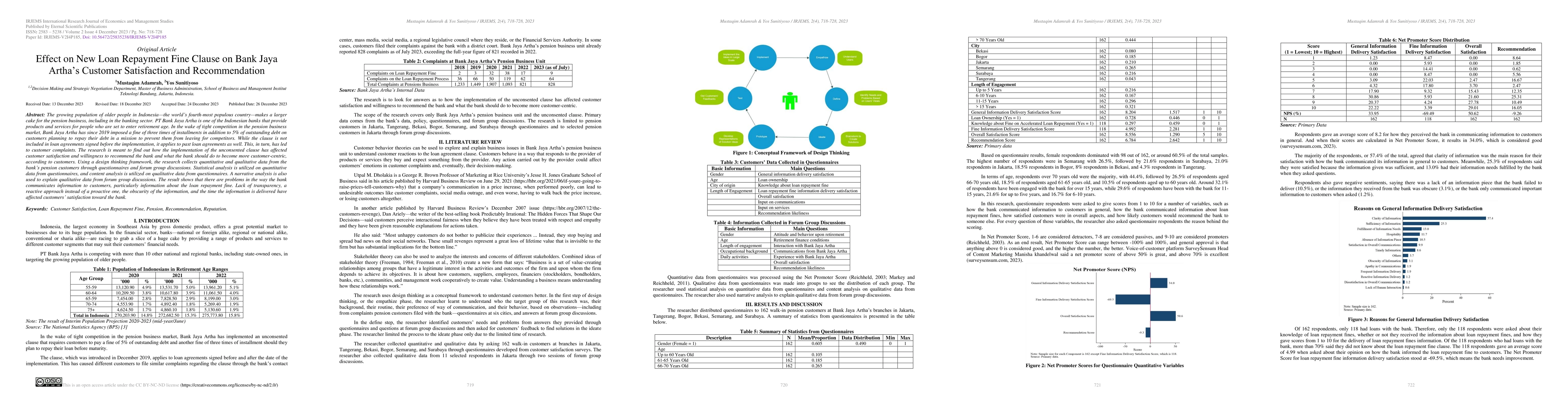

The growing population of older people in Indonesia--the world's fourth-most populous country--makes a larger cake for the pension business, including in the banking sector. PT Bank Jaya Artha is one of the Indonesian banks that provide products and services for people who are set to enter retirement age. In the wake of tight competition in the pension business market, Bank Jaya Artha has since 2019 imposed a fine of three times of installments in addition to 5% of outstanding debt on customers planning to repay their debt in a mission to prevent them from leaving for competitors. While the clause is not included in loan agreements signed before the implementation, it applies to past loan agreements as well. This, in turn, has led to customer complaints. The research is meant to find out how the implementation of the unconsented clause has affected customer satisfaction and willingness to recommend the bank and what the bank should do to become more customer-centric, according to customers. Using a design thinking framework, the research collects quantitative and qualitative data from the bank's pension customers through questionnaires and forum group discussions. Statistical analysis is utilized on quantitative data from questionnaires, and content analysis is utilized on qualitative data from questionnaires. A narrative analysis is also used to explain qualitative data from forum group discussions. The result shows that there are problems in the way the bank communicates information to customers, particularly information about the loan repayment fine. Lack of transparency, a reactive approach instead of a proactive one, the obscurity of the information, and the time the information is delivered have affected customers' satisfaction toward the bank.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)