Authors

Summary

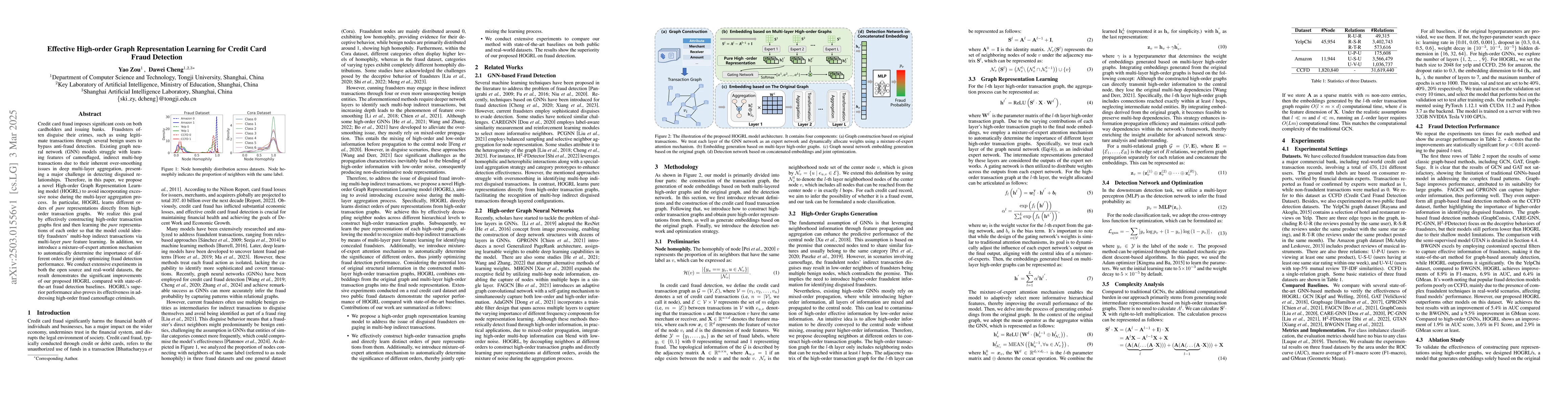

Credit card fraud imposes significant costs on both cardholders and issuing banks. Fraudsters often disguise their crimes, such as using legitimate transactions through several benign users to bypass anti-fraud detection. Existing graph neural network (GNN) models struggle with learning features of camouflaged, indirect multi-hop transactions due to their inherent over-smoothing issues in deep multi-layer aggregation, presenting a major challenge in detecting disguised relationships. Therefore, in this paper, we propose a novel High-order Graph Representation Learning model (HOGRL) to avoid incorporating excessive noise during the multi-layer aggregation process. In particular, HOGRL learns different orders of \emph{pure} representations directly from high-order transaction graphs. We realize this goal by effectively constructing high-order transaction graphs first and then learning the \emph{pure} representations of each order so that the model could identify fraudsters' multi-hop indirect transactions via multi-layer \emph{pure} feature learning. In addition, we introduce a mixture-of-expert attention mechanism to automatically determine the importance of different orders for jointly optimizing fraud detection performance. We conduct extensive experiments in both the open source and real-world datasets, the result demonstrates the significant improvements of our proposed HOGRL compared with state-of-the-art fraud detection baselines. HOGRL's superior performance also proves its effectiveness in addressing high-order fraud camouflage criminals.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes a novel High-order Graph Representation Learning model (HOGRL) that constructs high-order transaction graphs and learns pure representations of each order to identify multi-hop indirect transactions, employing a mixture-of-expert attention mechanism for optimizing fraud detection performance.

Key Results

- HOGRL effectively addresses the over-smoothing issue in deep multi-layer aggregation of GNN models for detecting camouflaged fraud transactions.

- Extensive experiments on open-source and real-world datasets demonstrate HOGRL's significant improvements over state-of-the-art fraud detection baselines.

- HOGRL proves effective in identifying high-order fraud camouflage criminals.

Significance

This research is important as it tackles the challenge of detecting disguised relationships in credit card fraud, which incurs substantial costs for cardholders and banks. By proposing HOGRL, the work aims to enhance fraud detection accuracy and efficiency.

Technical Contribution

The main technical contribution is the development of HOGRL, a model that learns high-order pure representations from transaction graphs, avoiding excessive noise during multi-layer aggregation and employing a mixture-of-expert attention mechanism.

Novelty

HOGRL distinguishes itself by directly learning pure representations of different orders from high-order transaction graphs, addressing the limitations of existing GNN models in detecting camouflaged, indirect multi-hop transactions.

Limitations

- The paper does not discuss potential computational resource requirements for implementing HOGRL.

- Limitations in generalizability to other types of fraud or different domains are not explored.

Future Work

- Investigate the applicability of HOGRL to other fraud detection domains or various types of financial transactions.

- Explore the computational complexity and optimization of HOGRL for real-time fraud detection systems.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Semi-supervised Credit Card Fraud Detection via Attribute-Driven Graph Representation

Ling Chen, Yefeng Zheng, Yi Ouyang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)