Summary

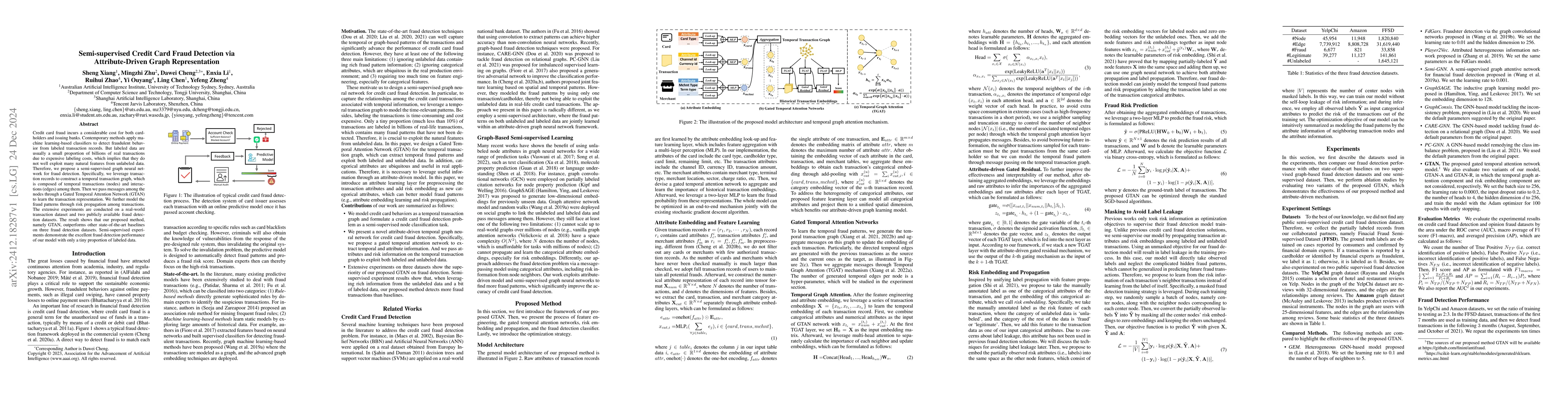

Credit card fraud incurs a considerable cost for both cardholders and issuing banks. Contemporary methods apply machine learning-based classifiers to detect fraudulent behavior from labeled transaction records. But labeled data are usually a small proportion of billions of real transactions due to expensive labeling costs, which implies that they do not well exploit many natural features from unlabeled data. Therefore, we propose a semi-supervised graph neural network for fraud detection. Specifically, we leverage transaction records to construct a temporal transaction graph, which is composed of temporal transactions (nodes) and interactions (edges) among them. Then we pass messages among the nodes through a Gated Temporal Attention Network (GTAN) to learn the transaction representation. We further model the fraud patterns through risk propagation among transactions. The extensive experiments are conducted on a real-world transaction dataset and two publicly available fraud detection datasets. The result shows that our proposed method, namely GTAN, outperforms other state-of-the-art baselines on three fraud detection datasets. Semi-supervised experiments demonstrate the excellent fraud detection performance of our model with only a tiny proportion of labeled data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)