Authors

Summary

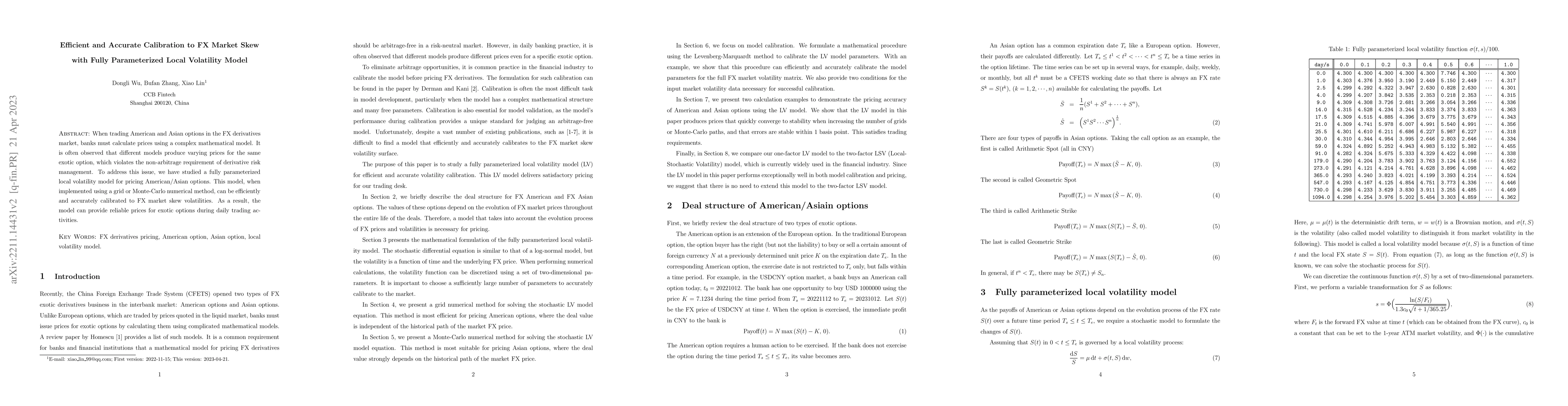

When trading American and Asian options in the FX derivatives market, banks must calculate prices using a complex mathematical model. It is often observed that different models produce varying prices for the same exotic option, which violates the non-arbitrage requirement of derivative risk management. To address this issue, we have studied a fully parameterized local volatility model for pricing American/Asian options. This model, when implemented using a grid or Monte-Carlo numerical method, can be efficiently and accurately calibrated to FX market skew volatilities. As a result, the model can provide reliable prices for exotic options during daily trading activities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)