Summary

We study the local volatility function in the Foreign Exchange market where both domestic and foreign interest rates are stochastic. This model is suitable to price long-dated FX derivatives. We derive the local volatility function and obtain several results that can be used for the calibration of this local volatility on the FX option's market. Then, we study an extension to obtain a more general volatility model and propose a calibration method for the local volatility associated to this model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

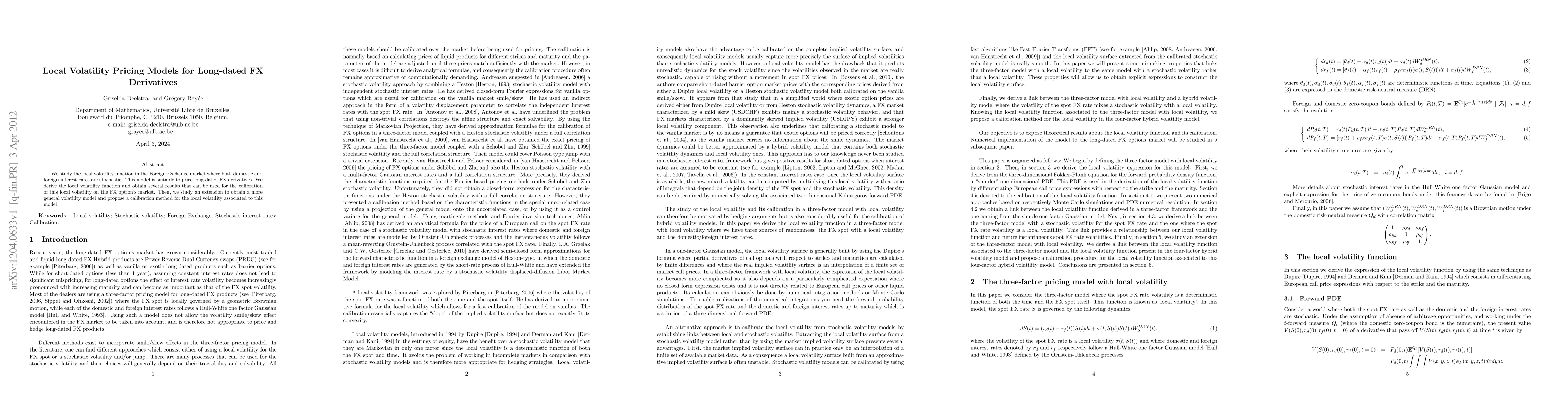

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient and Accurate Calibration to FX Market Skew with Fully Parameterized Local Volatility Model

Xiao Lin, Dongli Wu, Bufan Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)