Summary

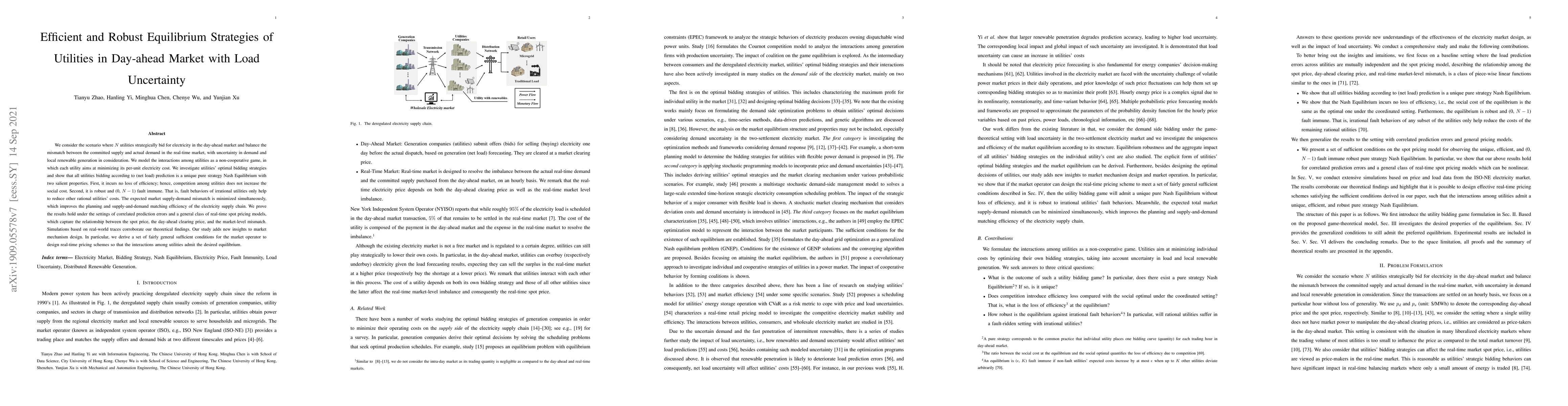

We consider the scenario where $N$ utilities strategically bid for electricity in the day-ahead market and balance the mismatch between the committed supply and actual demand in the real-time market, with uncertainty in demand and local renewable generation in consideration. We model the interactions among utilities as a non-cooperative game, in which each utility aims at minimizing its per-unit electricity cost. We investigate utilities' optimal bidding strategies and show that all utilities bidding according to (net load) prediction is a unique pure strategy Nash Equilibrium with two salient properties. First, it incurs no loss of efficiency; hence, competition among utilities does not increase the social cost. Second, it is robust and (0, $N-1$) fault immune. That is, fault behaviors of irrational utilities only help to reduce other rational utilities' costs. The expected market supply-demand mismatch is minimized simultaneously, which improves the planning and supply-and-demand matching efficiency of the electricity supply chain. We prove the results hold under the settings of correlated prediction errors and a general class of real-time spot pricing models, which capture the relationship between the spot price, the day-ahead clearing price, and the market-level mismatch. Simulations based on real-world traces corroborate our theoretical findings. Our study adds new insights to market mechanism design. In particular, we derive a set of fairly general sufficient conditions for the market operator to design real-time pricing schemes so that the interactions among utilities admit the desired equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNash Equilibrium of Joint Day-ahead Electricity Markets and Forward Contracts in Congested Power Systems

Henrik Madsen, Mohsen Banaei, Razgar Ebrahimy et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)