Summary

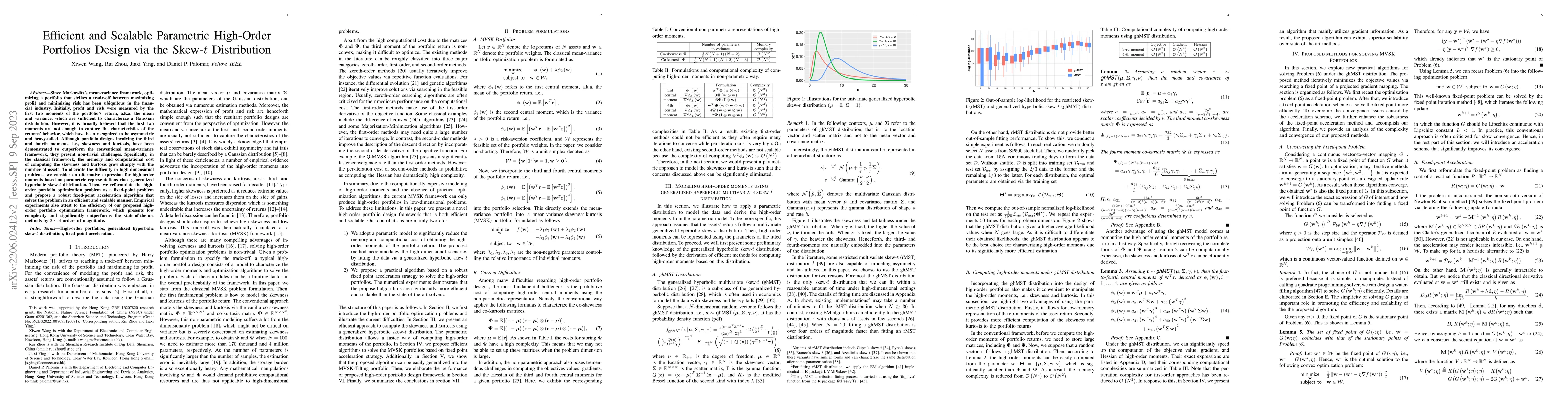

Since Markowitz's mean-variance framework, optimizing a portfolio that maximizes the profit and minimizes the risk has been ubiquitous in the financial industry. Initially, profit and risk were measured by the first two moments of the portfolio's return, a.k.a. the mean and variance, which are sufficient to characterize a Gaussian distribution. However, it is broadly believed that the first two moments are not enough to capture the characteristics of the returns' behavior, which have been recognized to be asymmetric and heavy-tailed. Although there is ample evidence that portfolio designs involving the third and fourth moments, i.e., skewness and kurtosis, will outperform the conventional mean-variance framework, they are non-trivial. Specifically, in the classical framework, the memory and computational cost of computing the skewness and kurtosis grow sharply with the number of assets. To alleviate the difficulty in high-dimensional problems, we consider an alternative expression for high-order moments based on parametric representations via a generalized hyperbolic skew-t distribution. Then, we reformulate the high-order portfolio optimization problem as a fixed-point problem and propose a robust fixed-point acceleration algorithm that solves the problem in an efficient and scalable manner. Empirical experiments also demonstrate that our proposed high-order portfolio optimization framework is of low complexity and significantly outperforms the state-of-the-art methods by 2 to 4 orders of magnitude.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTractable Unified Skew-t Distribution and Copula for Heterogeneous Asymmetries

Michael Stanley Smith, Lin Deng, Worapree Maneesoonthorn

| Title | Authors | Year | Actions |

|---|

Comments (0)