Authors

Summary

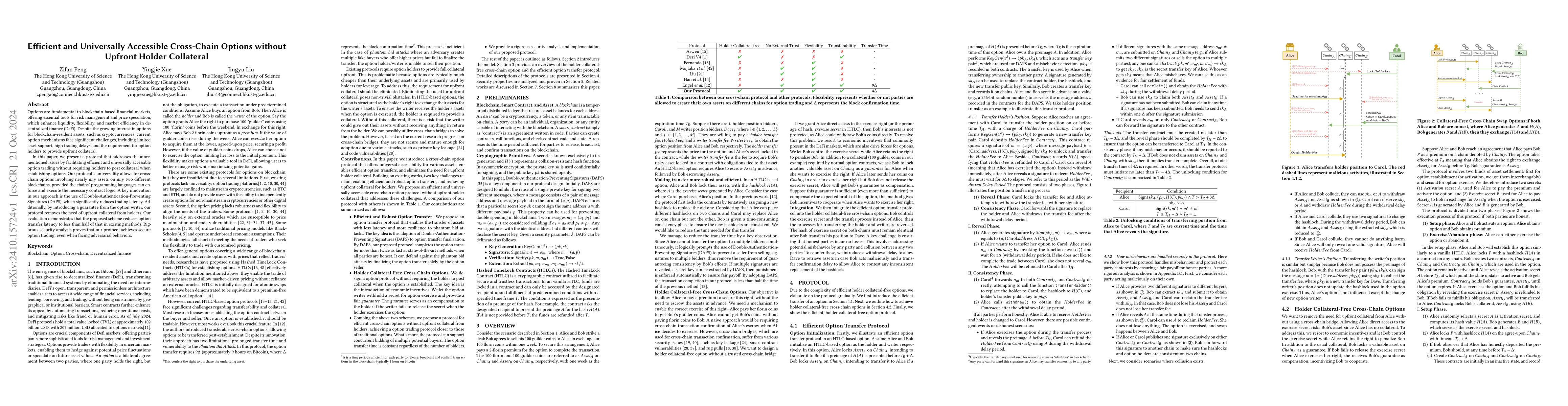

Options are fundamental to blockchain-based financial markets, offering essential tools for risk management and price speculation, which enhance liquidity, flexibility, and market efficiency in decentralized finance (DeFi). Despite the growing interest in options for blockchain-resident assets, such as cryptocurrencies, current option mechanisms face significant challenges, including limited asset support, high trading delays, and the requirement for option holders to provide upfront collateral. In this paper, we present a protocol that addresses the aforementioned issues by facilitating efficient and universally accessible option trading without requiring holders to post collateral when establishing options. Our protocol's universality allows for cross-chain options involving nearly $\textit{any}$ assets on $\textit{any}$ two different blockchains, provided the chains' programming languages can enforce and execute the necessary contract logic. A key innovation in our approach is the use of Double-Authentication-Preventing Signatures (DAPS), which significantly reduces trading latency. Additionally, by introducing a guarantee from the option writer, our protocol removes the need of upfront collateral from holders. Our evaluation demonstrates that the proposed scheme reduces option transfer latency to less than half of that in existing methods. Rigorous security analysis proves that our protocol achieves secure option trading, even when facing adversarial behaviors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Channel: Scalable Off-Chain Channels Supporting Fair and Atomic Cross-Chain Operations

Yong Yu, Yihao Guo, Minghui Xu et al.

No citations found for this paper.

Comments (0)