Authors

Summary

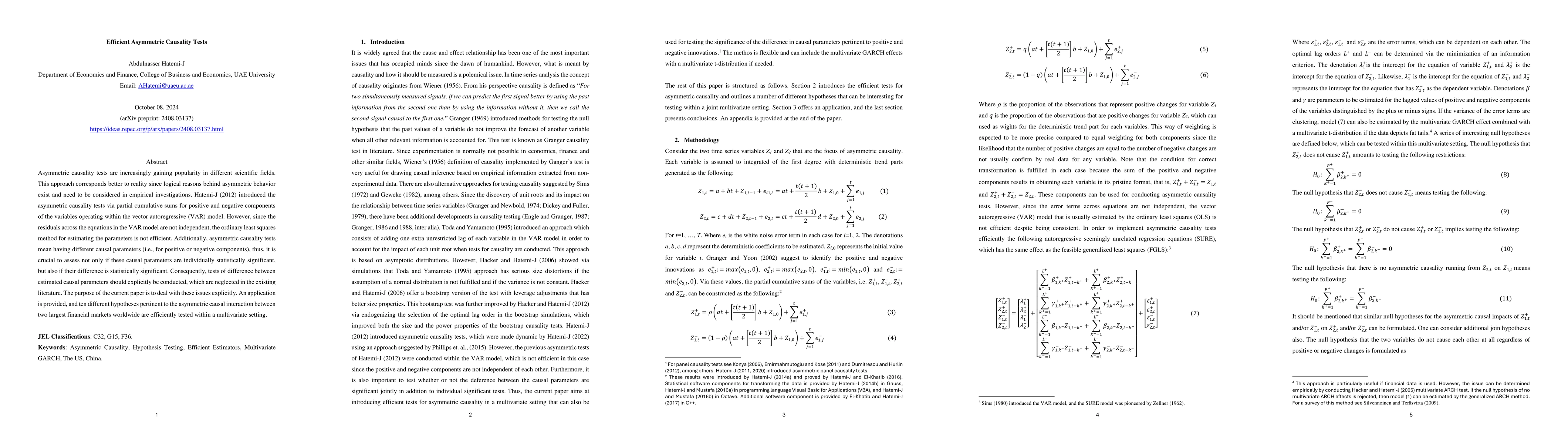

Asymmetric causality tests are increasingly gaining popularity in different scientific fields. This approach corresponds better to reality since logical reasons behind asymmetric behavior exist and need to be considered in empirical investigations. Hatemi-J (2012) introduced the asymmetric causality tests via partial cumulative sums for positive and negative components of the variables operating within the vector autoregressive (VAR) model. However, since the residuals across the equations in the VAR model are not independent, the ordinary least squares method for estimating the parameters is not efficient. Additionally, asymmetric causality tests mean having different causal parameters (i.e., for positive or negative components), thus, it is crucial to assess not only if these causal parameters are individually statistically significant, but also if their difference is statistically significant. Consequently, tests of difference between estimated causal parameters should explicitly be conducted, which are neglected in the existing literature. The purpose of the current paper is to deal with these issues explicitly. An application is provided, and ten different hypotheses pertinent to the asymmetric causal interaction between two largest financial markets worldwide are efficiently tested within a multivariate setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)